Types of insurance include Life Insurance, Health Insurance, Motor Insurance, Home Insurance, Travel Insurance, Commercial Insurance, Liability Insurance, Fire Insurance, Crop Insurance, and Marine Insurance. Each caters to specific financial risks and protection needs.

What is life insurance?

Life insurance is a contract signed between an individual and a life insurance company. The individual pays a certain premium at fixed intervals. In contrast, the insurance company pays the beneficiaries the insured amount on the occurrence of the insured event like death/disability or defined benefit of the product on maturity.

Once you have understood what life insurance is, it is also necessary to know how life insurance works.

The principle of life insurance is simple. As the insured, you would have a sum in mind that you may want a life insurance policy for. You will need to keep in mind that this amount should be able to cover the expenses of your family members in case of an unfortunate event.

The insurance company will calculate the premium amount you need to pay based on this amount. You will pay this premium amount, the insured, either in instalments or a lump sum. Do note that the premiums need to be paid for a predefined tenure set by the insurance company or as opted by you at the policy's inception.

The life insurance policy amount or sum assured is only given to the beneficiary after the policyholder’s death. This amount will be the sum assured plus other accrued benefits, if any, as stated in the policy document.

Benefits of life insurance

The biggest benefit of life insurance is it helps in creating a safe financial nest for your family. The benefits continue. If you intend to purchase a new life insurance policy, you should familiarise yourself with its benefits. We’ve listed a few down below:

Financial Security

One of the primary benefits of having life insurance is to provide a safety net for your family. In case of an unfortunate event, the proceeds from the death benefit can be used by the beneficiaries to meet their expenses and not worry about reaching their financial & life goals. Also, note that the death benefit proceeds are entirely tax-free. Life Insurance provides financial support in case of any unfortunate event.

Some policies are also known to provide maturity benefits. The proceeds from this payout can be used to fulfil the long-term goals of the family and provide financial stability to the family as well.

Securing your child’s future

The primary objective in a Child Plan is to build a corpus for their higher Education / Marriage and to fulfil any other milestones set by their Parent / Guardian. More importantly, a Child Insurance Plan provides a safety cushion in case of any unfortunate event as most of these plans come with a premium waiver benefit, whereby the insurance company takes care of the burden of paying future premiums, thereby safeguarding the maturity amount.

Upon maturity, the payout will be paid in a lump sum. You can also choose to receive the payouts at intervals to pay for certain life events like marriage or you can also choose to receive the payout at intervals to pay for certain life events like marriage or higher education of the child.

Retirement planning

Retirement planning is crucial today, especially where individuals no longer receive pensions, can depend on their children, and must deal with the inflationary effect on expenses. It essentially entails building a corpus and a steady stream of money post-retirement. There are specific plans that will help create a corpus for retirement, which is then used to purchase an annuity plan that helps to generate a fixed, regular income through a pension.

Tax benefits

While framing your tax planning, life insurance should also be considered. Besides the benefit of securing your family’s future, you can also claim tax deductions on the premiums paid and tax exemptions on maturity benefits paid out on a life insurance policy.

Assured benefits on death

Life insurance is primarily considered financial protection in case of an unfortunate event. Term life insurance policies usually offer a fixed sum assured that secures your loved ones in case of a demise of the life assured.

Risk mitigation and coverage

If you are the sole breadwinner of your family, one of your biggest worries is how your family would manage financially if an unfortunate event occurred. This is where life insurance comes in as a risk mitigation option.

The premise of life insurance is to mitigate risk and provide financial help to your survivors so that they are taken care of, even if you are not around.

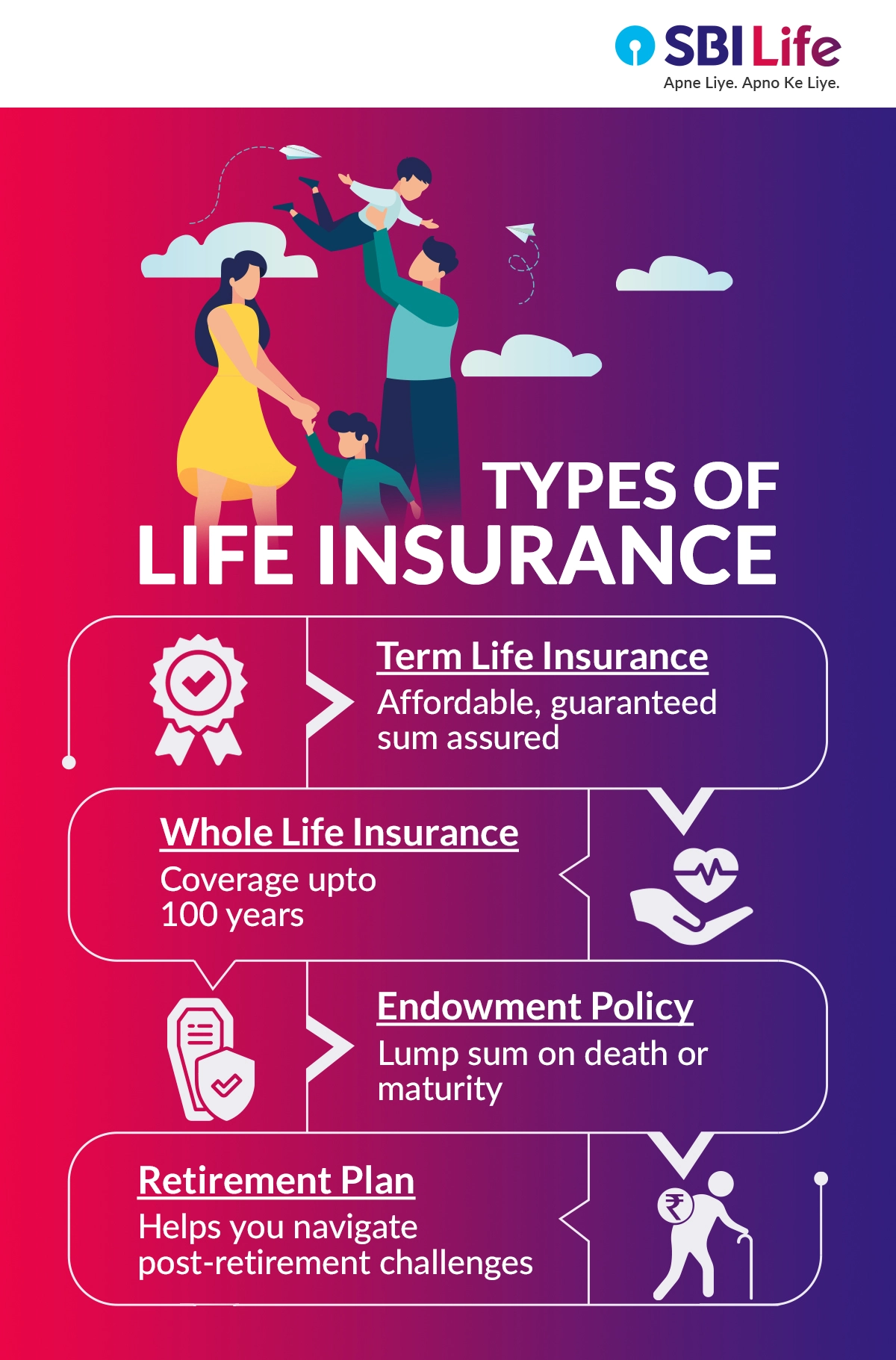

Understand types of life insurance policies to choose the right one

Now that you understand life insurance and the benefits of purchasing a policy, you must choose the right product. There are various types of life insurance policies, which includes:

Term life insurance

Term life insurance is one of the most popular forms of life insurance. Most people choose term life insurance as it provides high financial protection in the form of a sum assured at an affordable premium. However, pure-term insurance policies do not provide maturity benefits if the policyholder survives the policy term. Thus, life insurance policies are viewed as financial protection to the nominees of the policyholder in case of death during the policy term.

Whole life insurance

A type of insurance policy that provides coverage for the entire life, i.e., up to 100 years of age, is known as whole life insurance, which protects your family for an extended period. Most of these have a premium payment for a limited period or once. The policy will remain in force so long as the policyholder pays the required premiums on time.

Endowment policy

Designed specifically to give a lump sum upon the death of the policyholder or on maturity, this type of life insurance is known as an endowment policy. If you want a product that can provide the dual benefits of insurance and savings, an endowment policy can be the right fit.

ULIPs (Unit linked Insurance Plans) offer dual benefits of Protection and Wealth creation. ULIPs come with diverse funds, like Equity, Debt, Money market etc. Depending on your risk appetite, ULIP offers flexibility, like switching between funds and liquidity through partial withdrawals. They offer a Minimum Guaranteed Death Benefit as a Sum Assured and market-linked benefits in the form of fund value being paid as maturity benefit.

*“ THE INVESTMENT RISK IS INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER”

Retirement plans

Retirement plans are pertinent to ensure an independent and comfortable retired life, especially in the absence of a social security scheme. These plans help you tide over various challenges an individual faces post-retirement, like steady income, combating inflation, medical expenses, meeting other unforeseen expenses etc.

FAQs about life insurance

Is life insurance worth considering as financial security incase of any uncertain event in?

You should consider life insurance if you have dependents and want to secure their future in the event of your absence financially. Life insurance helps create a financial safety net for your family so they can always fulfil their needs and desires.

What are the unique advantages each of these policies offers?

The various types of Life insurance policies that are available in India are as follows -

- Whole Life Insurance - provides long-term financial protection to you and your loved ones.

- Unit Linked Insurance Plan (ULIP) - provides dual benefits of insurance as well as investment options to achieve your long-term goals,

- Retirement Plan - helps you build a corpus for living a secured life post-retirement

- Money Back Plan – provides financial protection in the form of insurance that provides the dual benefit of protection to keep your loved ones secure, plus accumulated savings to get income at regular intervals as per your choice.

- Endowment Plan - providing a lump sum after the maturity period or the sum assured to the beneficiaries in the event of the policyholder's unfortunate demise.

At what age should you get life insurance?

As such, life insurance can be purchased at any age. Yet, it helps if one invests in a life insurance policy at an early age. Ideally, this would mean that you are in the prime of your health, which in turn helps availing insurance at lower premiums.

How can a nominee claim life insurance?

To claim a life insurance policy after death, you will need to follow these steps:

- A claim intimation has to be sent. This can be done online, or the duly filled form can be sent by post or by visiting a branch. A claim can also be intimated through email by mailing claims@sbilife.co.in

- You will need to submit the original policy copy.

- You will then need an attested copy of the original death certificate issued by a local authority.

- Photo identity proof and address proof of the claimant will also need to be submitted.

- Direct credit mandate form or photocopy of the bank passbook or cancelled cheque with the claimant's name printed must also be kept on hand.

- Additional documents can be requested, including the medical attendant’s certificate and hospital case papers. Also, depending on the information available, you may be required The FIR or post-mortem report will be needed in case of an accident.

How many beneficiaries can be on a life insurance policy?

You can choose one or more beneficiaries on your life insurance policy. If you choose more than one person, you must mention the amount each beneficiary should receive after your demise.

What is the importance of Nominees in Life Insurance?

A nominee is usually the person/s who can legally claim the benefits of a life insurance policy in the event of the policyholder's unfortunate demise. The nominee/s has to be appointed at the time of purchasing the policy and can also be changed in the course of the policy if required. Usually, people name the person they wish to provide financial protection for, in case they may not be around themselves, as nominee/s. Thus, nominees generally include the spouse, parents, or children of the insured person.

The primary purpose of life insurance is the financial protection of your loved ones, which is why you must have the correct nominee/s mentioned in your insurance policy.

What are the Factors that Affect Life Insurance?

Several factors play a key role in the type of life insurance you can purchase and the value of the insurance premium. These include -

- Age - Your date of birth or birth year can impact your life insurance premium. It is safe to say that younger policyholders pay lower premiums than older ones. The reason is that the older you get, the greater the risk, which increases the possibility of your insurer paying out your policy claim sooner than a policy for a younger person.

- Gender - Several notable studies have concluded that women live longer than men. This means that women tend to pay lower premiums than the opposite gender.

- Health and Ailments - Before purchasing a life insurance policy, the insurer may ask for your past medical records. In case of serious health conditions like diabetes, cancer, or cardiovascular issues, you may need to pay a higher insurance premium or be unable to avail of insurance. Other metrics, like cholesterol levels, blood pressure, surgeries, etc., may also influence your premium amount.

- Family health records - Insurers ask for family history to identify potentially fatal health issues or genetic disorders. These may also impact your premiums.

Other factors like occupation, unhealthy habits like smoking, and extracurricular activities like participating in adventure sports may also affect your life insurance premium.

What are the common mistakes everybody makes while buying Life Insurance?

With the number of available options, choosing a life insurance policy can be confusing. However, here are some common mistakes to avoid when you go about choosing the insurance policy that is suited to your need -

- Delaying the purchase of a life insurance policy

- Not availing enough coverage, benefits, and tenure

- Availing policy without adequate research & risk appetite

- Citing incorrect information like date of birth, address, name of the nominee, etc.

- Failing to read through eligibility criteria and terms of policy beforehand

- Not disclosing material facts especially related to the insured’s health.

Are you aware of how affordable life insurance can be?

Most insurers offer flexible, goal-based, and term-based insurance policies, with premiums that come according to the option selected. Term insurance policies are usually the most cost-effective and offer reasonably large coverage with affordable premiums. Additionally, there are various other options available to suit the varying needs of people, such as retirement plans, money-back plans, plans for savings, and children, among others. Each of these can be customised to suit affordability as per an individual’s needs. Moreover, most insurers also offer optional riders such as accidental death and disability benefits that can enhance your insurance policy's protection at a nominal additional premium.

Remember that factors such as age, health status, smoker status, etc., also affect your premium amount.

Is there anyone who is currently reliant on your income? How will Life insurance help them in your absence?

A life insurance policy is considered a necessity in today’s uncertain times. This is especially true if you are sole breadwinner in the family.

This is where Life insurance comes in. In the event of your absence, the proceeds from your life insurance will help them continue to lead the life for which you have worked so hard. In simple terms, life insurance will create a safety net to protect your family financially in your absence.

What are the tax benefits available when you invest in Life Insurance?

- Under Section 80C of the Income Tax Act, you can claim a deduction for a contribution towards a life insurance premium up to a maximum amount of INR 1,50,000. Do note tax deduction is applicable only if the individual files their tax return as per the old income tax regime, i.e. who has not opted for the option under section 115BAC of the Act.

- Maturity benefits are exempted under section 10(10D) of the Income Tax Act, 1961, subject to certain conditions. Death proceeds are completely exempted.

- The income tax laws are subject to change from time to time.

Can you purchase life insurance plans online?

If you are in search of the ideal life insurance policy to safeguard your family’s future, you can scout for policy options online. The following are some insights into buying an insurance plan online -

- Lower cost – Insurers tend to offer discounts when buying life insurance products online

- Transparency leads to better decision-making – Insurers typically provide all details related to any policy online. What’s more, this allows you to check and compare similar products by other companies in terms of features offered and prices. Since all the required details about the insurance policy are easily available at your disposal, there is utmost transparency. This allows you to make a more informed decision as to which product would be the right fit for your needs.

- Ease and Convenience – The whole process of buying a life insurance policy, including submission of documents, making the payment to receipt of the policy, can be done online from the ease of your home or office.

By when can one expect the sum assured after completing the claim procedure?

Once all the documents have been submitted, the time taken to process the claim is set by the Insurance Regulatory and Development Authority. For claims that require investigation by the insurance company, this is set as 90 working days from the date of intimation to the date of investigation completion & 30 working days from the date of receipt of the investigation report to the date of payout. For non-investigated claims, this is set as 30 working days from the date of intimation/receipt of all requirements to the payout date.

How to revive the lapsed Life Insurance policy?

To revive your lapsed life insurance policy, in the case of a term/traditional policy, you will need to pay all due unpaid premiums along with the interest amount as applicable. In the case of a ULIP, you must pay all due unpaid premiums. The revival option for a life insurance policy remains available for a period of up to 5 years from the initial unpaid premium. This allows policyholders to reinstate coverage within the stipulated timeframe – as per the terms & conditions of the product.

LIARC/ver1/09/23/WEB/ENG

5 Minute

|

5 Minute

|

6 Minute |

6 Minute |