SBI Life at a Glance

SBI Life stands at the forefront of India's life insurance landscape, safeguarding the aspirations of millions of individuals and their loved ones. With a customer-centric ethos and unparalleled distribution reach, we offer a comprehensive suite of insurance solutions catering to various age groups and life stage needs.

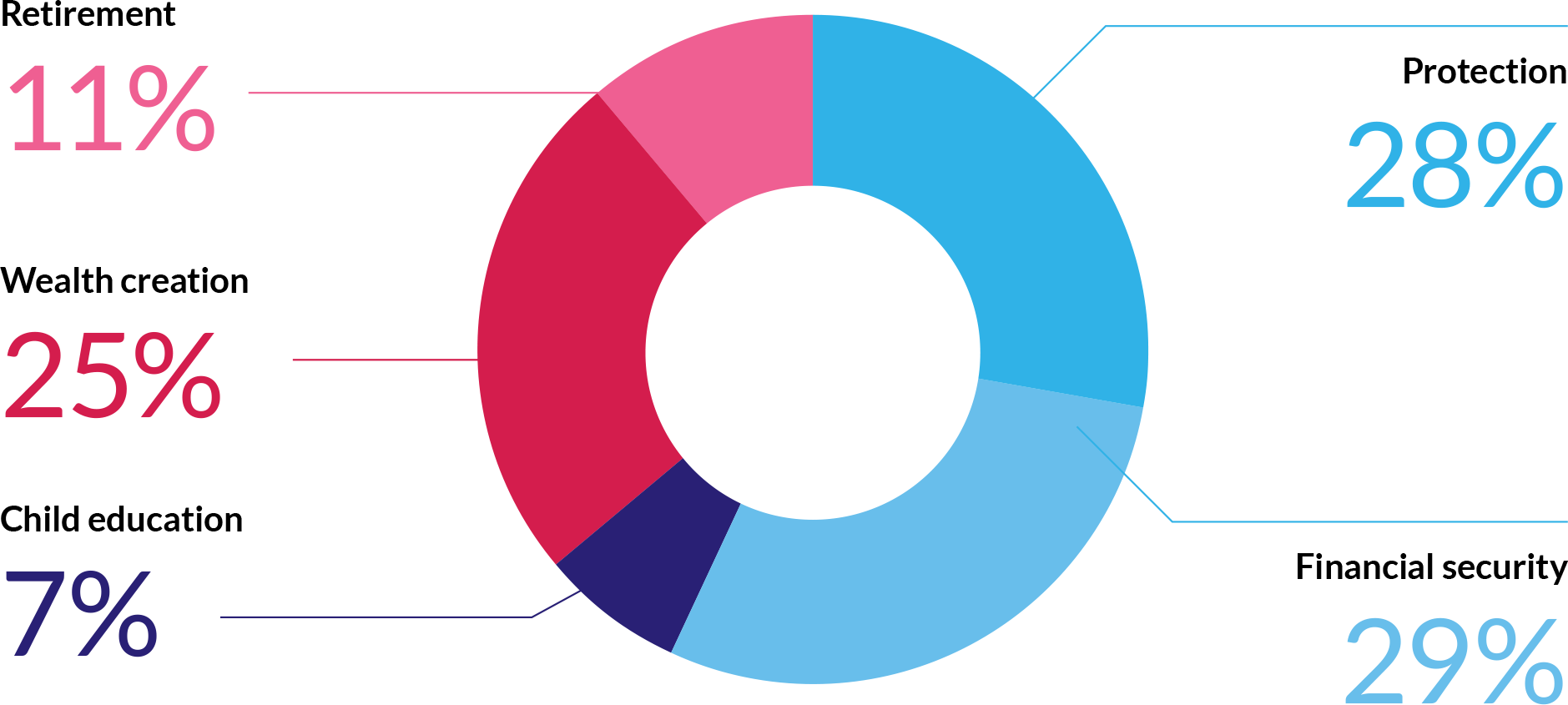

Suite of offerings

(Share in Individual NB policies)

Purpose-driven strategy

Brand purpose

Liberate individuals to pursue their dreams, by securing the needs and aspirations of their loved ones.

Strategic objectives

Robust distribution model with unparalleled reach

Sustainable growth with value creation

Customer engagement with enhanced experience

Building skilled and capable human capital

Expanding digital footprints for seamless journey

Driven by our values

We provide information which is clear & concise in addition to having simple processes which are effective and easy to understand.

We are curious & open to learn from anyone & anywhere because we believe in introspection & continuous improvement.

We are honest, open, fair & will always follow sound ethical principles

We bring new ideas to life with an intention to improve, customise and stay relevant.

We shall work with selfless concern towards long-term well-being and welfare of our community.

Attributes that distinguish SBI Life in the industry

Market leadership and brand reputation

SBI Life has cemented its position as one of the top players in the life insurance industry, consistently improving its market share and performance. The Company’s notable presence in individual-rated premiums demonstrates its market leadership. With a successful track record spanning over two decades, SBI Life has established a strong brand reputation, instilling trust and confidence among its stakeholders.

Private market share in

Individual Rated Premium

Private market share in

New Business Premium

Private market share in

Individual New Policies

Financial strength and stability

SBI Life demonstrates a robust financial position, ensuring stability and long-term growth. Supported by SBI as the majority stakeholder, the Company maintains an adequate capital position and healthy solvency margin. Its strong embedded value growth and favourable value-to-net worth ratio reflect a solid capital foundation. With consistent internal cash accrual, SBI Life effectively balances capital requirements while achieving sustainable business growth.

Solvency ratio

Net worth

Robust persistency, profitability and margin

SBI Life's robust persistence across its product portfolio sets it apart from competitors. The Company excels in retaining policyholders over extended periods, underscoring its ability to provide long-term value to customers. This coupled with healthy cash accrual and a historically favourable return on equity, showcases SBI Life's profitability. With a strong value of new business margin and consistent growth in the value of new business, the Company is well-positioned for sustainable profitability.

13th month persistency ratio (based on premium)

Profit after tax

up 14% y-o-y

61st month persistency ratio (based on premium)

VoNB Margin

ROEV

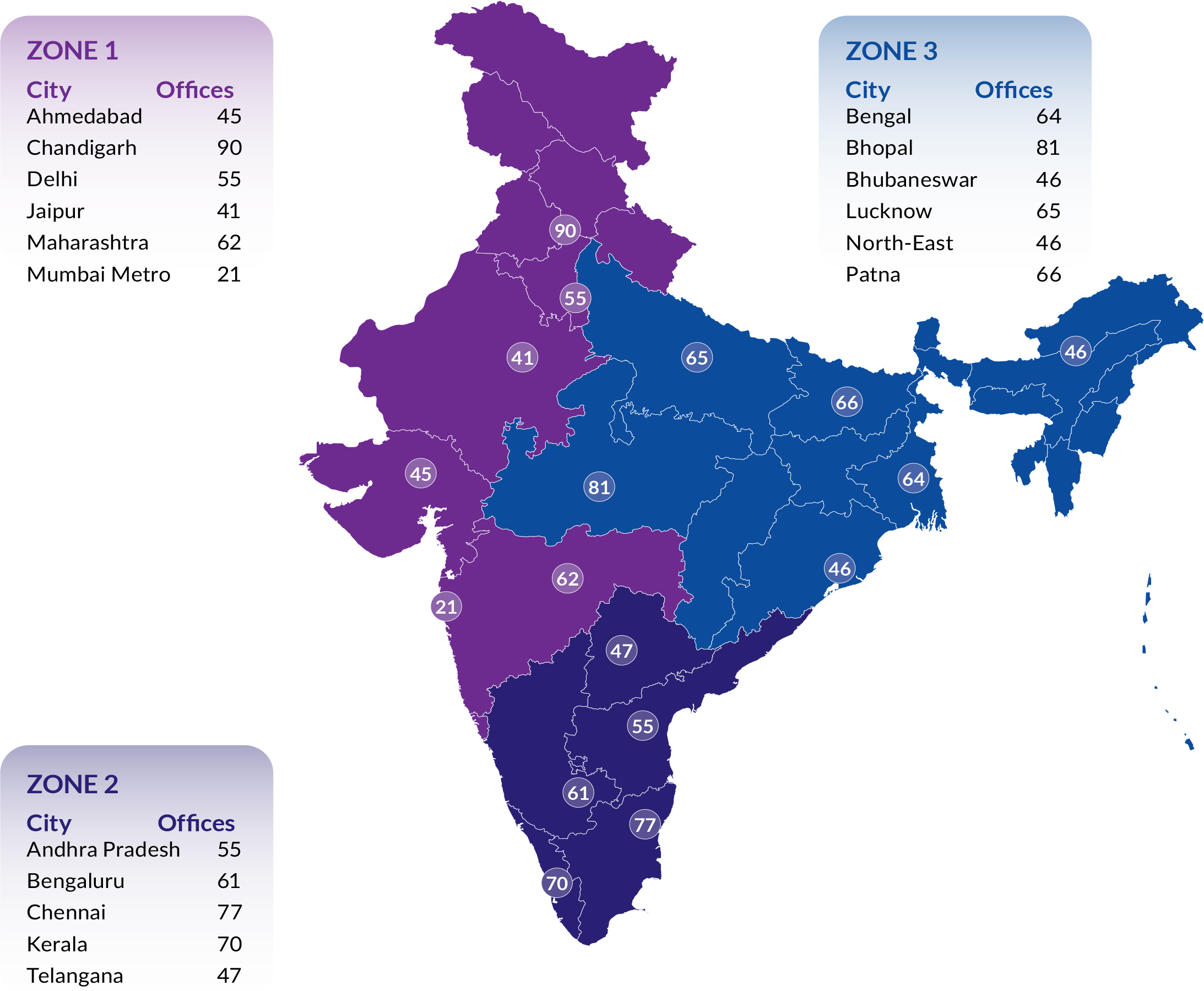

Unparalleled distribution reach

SBI Life benefits from an extensive and diversified distribution network, amplifying its market reach and customer accessibility. Leveraging SBI's extensive branch network provides SBI Life with a competitive advantage, enabling wider distribution and customer engagement. Synergies with partners and strategic cross-selling initiatives bolster market penetration. Notably, SBI Life's strong partnerships with renowned banks and its branch network further enhance its distribution capabilities, ensuring comprehensive customer support.

Trained insurance personnel

Partner branches

Brokers

Corporate agents

Bancassurance partners

Offices

With a robust distribution network across India, SBI Life extends its services to millions, securing their financial future with care and precision, even in the remotest corners of India. Through strategic expansion, valuable partnerships, and digital innovation, we amplify our impact, providing comprehensive insurance solutions that secure the financial future of individuals across India.

Our journey of excellence garnered us a multitude of prestigious awards and accolades. These honours stand as a testament to our relentless pursuit of excellence, innovation, customer-centricity, and sustainable practices. As we move forward, we aim to deliver strong performance, drive positive impact, and even achieve greater heights.