Empowering Life of Our Stakeholders

With a steadfast commitment to putting customers first, we have developed a comprehensive range of innovative insurance solutions tailored to meet our customers’ unique needs. Our cutting-edge technology, streamlined processes and dedicated team ensure a seamless and hassle-free experience throughout the customer lifecycle.

Material issues

Strategic objective

Focus areas

Key highlights

Customer-centric approach

Our strong customer-connect is a result of our ability to effectively address both the existing and evolving needs of our customers. At SBI Life, we offer a wide range of traditional and unit-linked products and solutions that cater to diverse demographics and income levels.

Individual offerings

Group lives covered

Our range of protection plans is designed to safeguard the financial future of individuals and their families. These plans act as a safety net, offering life insurance coverage that provides peace of mind during unforeseen events. We offer a mix of traditional protection plans as well as unique products that offer coverage for both life and health, providing comprehensive protection for our customers.

Our savings plans not only provide life insurance coverage but also encourage disciplined savings habits. These plans are tailored to meet specific financial goals and offer stable returns, allowing our customers to accumulate savings while ensuring their long-term financial security.

We understand the importance of securing a child's future and our child plans are designed to do just that. These plans provide financial protection and support for children, enabling them to pursue their dreams and aspirations without any hindrances. Our portfolio includes both traditional and unit-linked child insurance plans, offering flexibility and customisation based on the risk appetite of our customers.

Our wealth creation plans are aimed at individuals who seek market-linked returns along with life insurance coverage. These plans provide an opportunity for customers to grow their wealth and investments while ensuring protection throughout the policy term.

We believe in helping individuals plan for a secure and fulfilling retirement. Our retirement plans assist customers in building a substantial corpus of funds to maintain their desired lifestyle and manage expenses during their golden years. These plans offer a comprehensive solution to ensure a comfortable retirement for our valued customers.

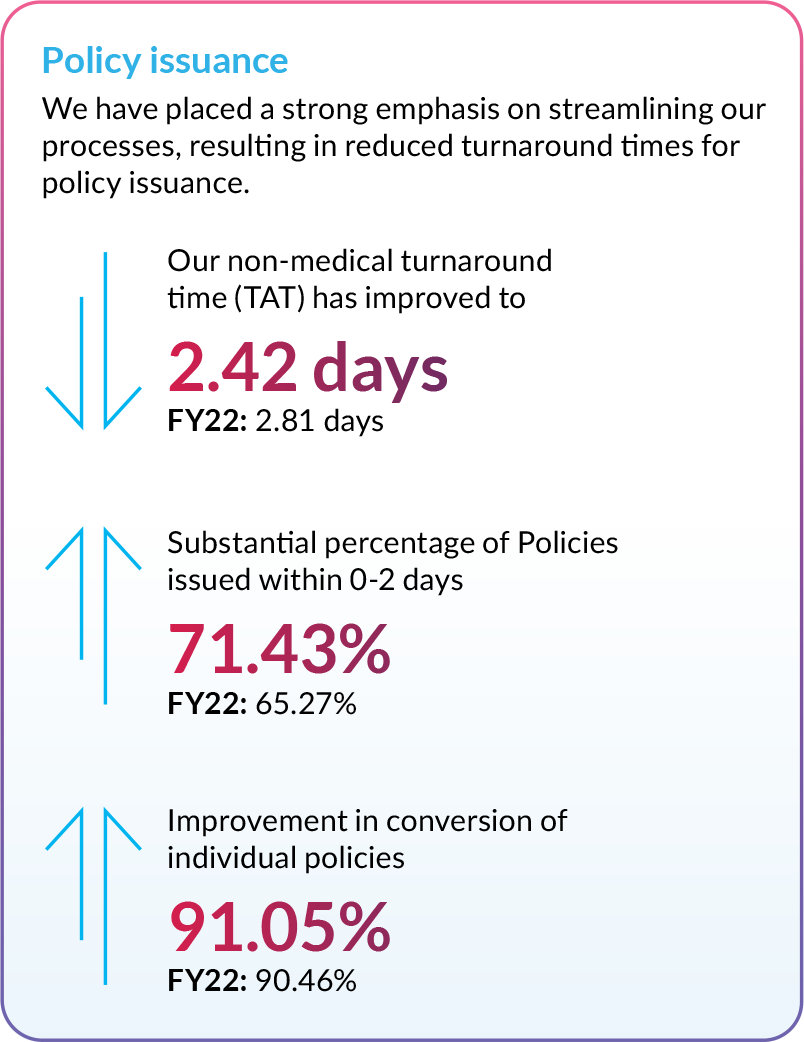

Enhancing customer experience through excellence

Fostering customer engagement

To ensure a long-term relationship with our customers and enhance their overall experience and engagement, we have implemented several measures and initiatives.

Personalised product videos: We believe in providing a product that meets our customers' needs and interests while maintaining transparency and ethical practices. As part of this commitment, we send personalised product videos to customers the day after they submit new applications. These videos reassure customers about our dedication to their satisfaction and provide a clear understanding of the product.

Calls made around key policy milestones: We proactively reach out to customers during important policy milestones to maintain a strong connection. Ahead of the first anniversary and the fifth policy anniversary, we make personal calls to customers whose policies fall in the 13th-month persistency bracket and 61st-month persistency bracket, respectively.

Personalised touch with messages on important milestones in their preferred language: To enhance the customer experience, we now send birthday greetings to policyholders in their preferred languages. This personalised touch demonstrates our commitment to building strong relationships with our customers.

Customer awareness campaigns on email, SMS and social media: Throughout the FY23, we conducted monthly customer awareness and education campaigns. These campaigns aimed to improve the adoption of digital services such as Smart Care, WhatsApp services, DigiLocker and IVRS self-service options. Additionally, we focused on creating awareness about insurance and financial planning, ensuring our customers have access to valuable information.

Customer communication management (CCM): To streamline and enhance customer communications at all policy stages, we initiated the customer communication management project. This project aims to standardise and simplify communications, reducing redundancy. As part of this effort, we have redesigned and implemented seven major bulk communication templates.

Communications to members enrolled under the YONO Insta Life Secure Scheme: To ensure timely communication and drive persistency, we have implemented eight additional SMS and email communications at different intervals of the policy life cycle. These communications inform customers in advance about their due renewal premiums, enabling them to stay informed and make timely payments.

Simplified auto-pay mandate registration for SBI accounts: We have introduced a simplified and integrated method for setting up renewal premium auto-debit instructions on SBI bank accounts. This streamlined process allows customers to activate direct debit instructions for future premium payments by providing simple consent during the payment of their first or renewal premium through Electronic Fund Transfer.

Increasing customer retention

Retention of policies needs to be tracked continuously and very closely with an aim to prevent exits at any stage during the term of the policy. Policies which are not paid on the renewal due date or within the grace period and policies that lapse due to non-payment of premiums are crucial from a customer retention perspective.

Policy revival campaigns

We have introduced personalised videos with revival quotes and payment links to enhance policy revival rates. These videos are specifically created for policyholders targeted in the revival campaigns, providing them with comprehensive information on policy benefits, the revival process, and a personalised revival quote.

In addition, we have embedded convenient links within the videos, allowing policyholders to easily submit their revival requests online. The implementation of personalised videos has resulted in a remarkable improvement in the conversion rates of our revival campaigns.

During the year, we successfully revived over 1.54 lakhs lapsed policies, amounting to ~8.04 bn towards renewal premiums. In two phases of the revival campaign launched this year, we aimed to revive lapsed policies and rebuild relationships with policyholders.

Surrender prevention

To reduce surrenders, we have intensified the Surrender Retention activity by launching a Surrender Prevention Tool which include following features:

Empowering Life of Our Stakeholders

Customer-first approach

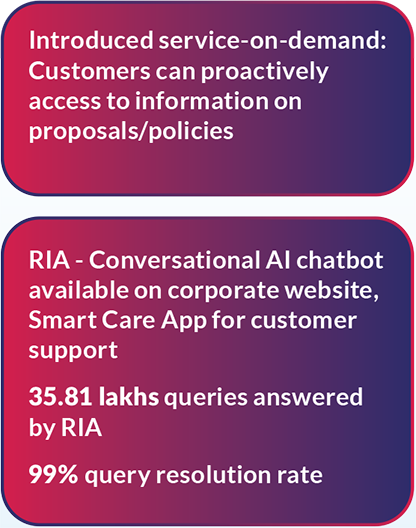

At SBI Life, we are committed to elevating the customer experience by implementing a range of initiatives that cater to their needs at every touchpoint. Through the integration of advanced technologies and digital solutions, we have optimised processes, improved operational efficiency, and provided exceptional service.

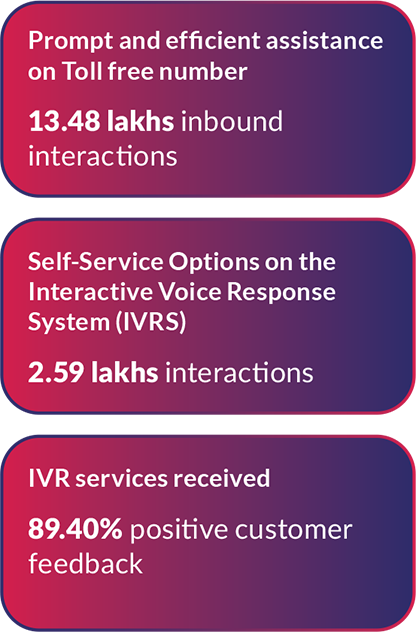

Contact centre

New missed call service

WhatsApp services

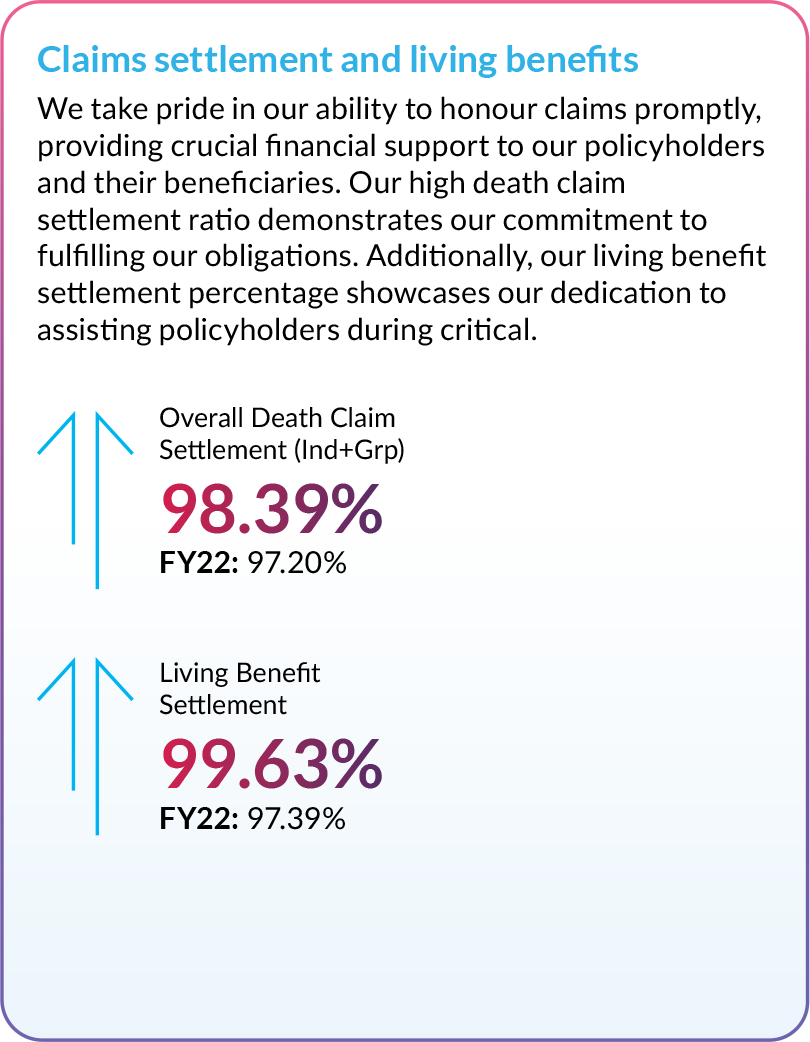

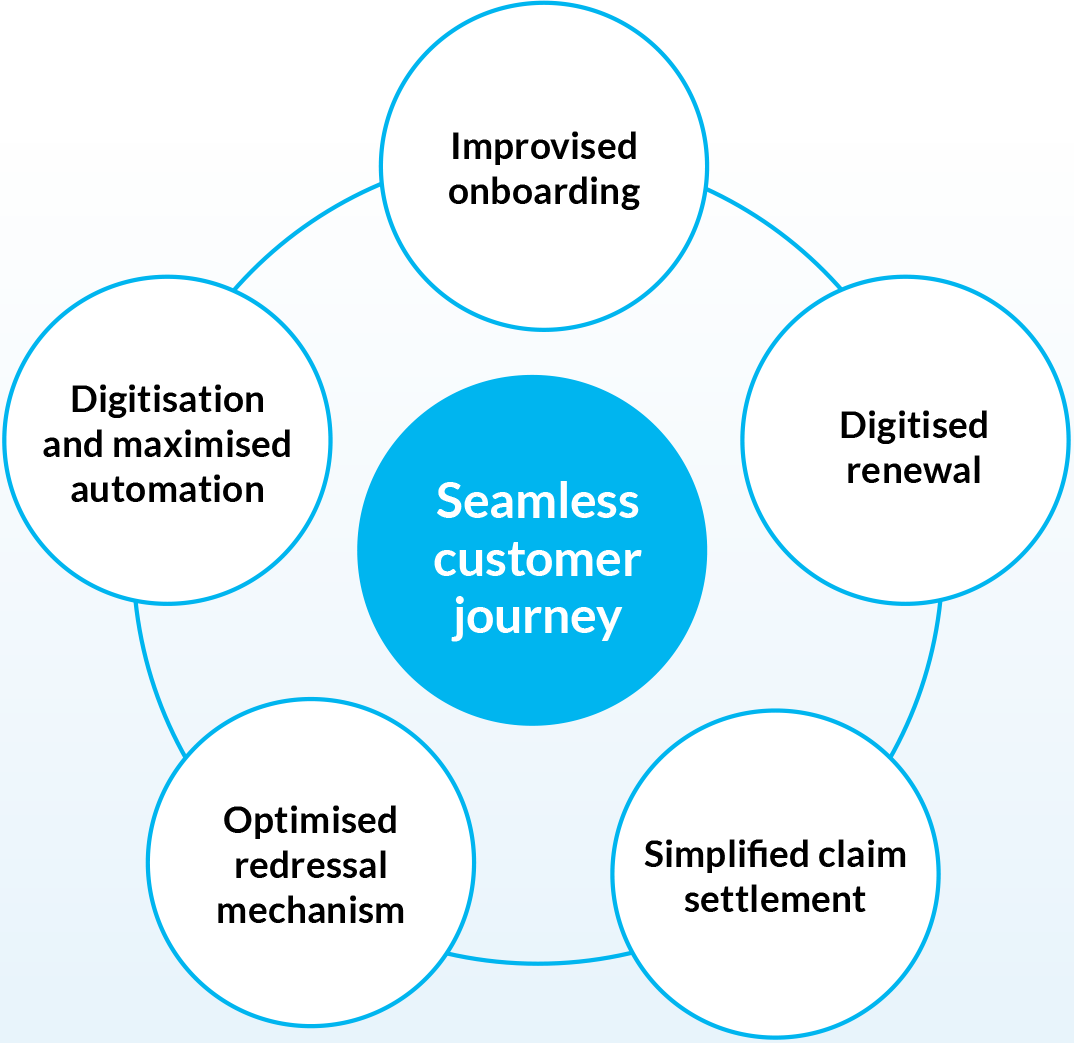

At SBI Life, we are dedicated to providing a hassle-free experience for our customers by implementing streamlined processes and embracing technology to simplify onboarding, digitise renewals, and ensure efficient claim settlement. Our optimised redressal mechanism promptly addresses customer grievances, and our digitisation efforts empower customers with self-service options. We continuously strive to enhance the customer experience, providing convenience and satisfaction at every interaction.

Improvised onboarding

Prioritising customer satisfaction

Customer satisfaction lies at the heart of our business, and we are committed to delivering exceptional experiences to our valued policyholders. Through continuous improvement and a customer-centric approach, we strive to exceed expectations and build long-lasting relationships.

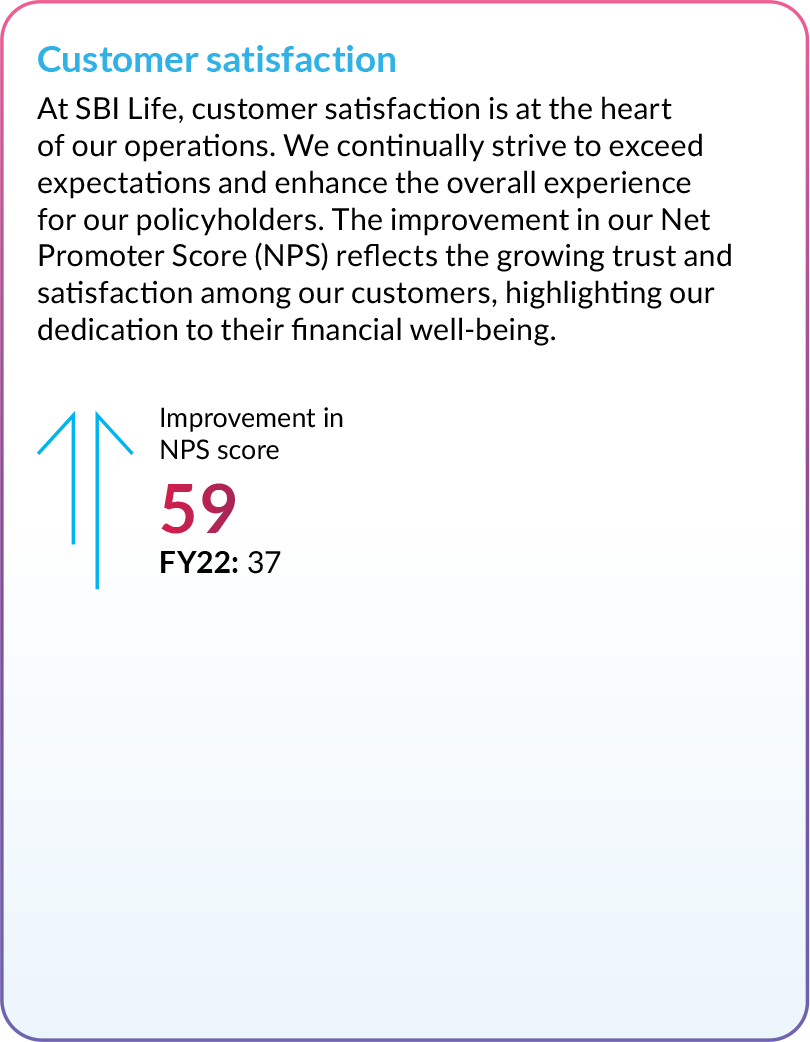

Net Promoter Score (NPS)

We highly value our customers' satisfaction, and we use the Net Promoter Score (NPS) as an essential metric to gauge their happiness. During the reporting year, we emphasised on enhancing response rates and proactively addressing process gaps or any areas for improvement based on customer feedback.

To enhance the convenience and accessibility of our Net Promoter Score (NPS) surveys, we introduced WhatsApp as a new mode alongside the existing options of e-mail and SMS. In addition, we have integrated the NPS survey on a real-time basis for our valued customers. With these efforts, the overall response rates for NPS have doubled to 8.31% in FY23 from 3.28% in FY22.

Brand built on

security, access,

trust and reliability

Our brand purpose is deeply rooted in understanding today's consumers and their perspectives on life insurance. We strive to help individuals in securing the needs and futures of their loved ones, enabling them to embrace life to the fullest while fulfilling their responsibilities.

Our unique perspective can be summarised as follows: SBI Life empowers individuals to strike a balance between personal aspirations and family obligations, freeing them to pursue their passions and paths.

Our powerful mantra, "Karo Poore Apne Iraade, Apno Se Kiye Sabhi Vaade - Apne Liye. Apno Ke Liye." resonates throughout the year, reflecting our dedication to putting consumers and their families at the heart of all we do. Through engaging conversations, we highlight the vital role of life insurance and cultivate a strong consideration for the SBI Life brand, as we continue to stand by our promise of enabling a better, more secure future for all.

We have always been committed to understanding the evolving needs of consumers. Today, a wave of 'Responsible Ambition' is spreading across the nation, where individuals strive to balance personal aspirations with family responsibilities.

Our integrated campaign, 'Responsible Ambition,' emphasises the importance of achieving one's dreams while setting a positive example for loved ones, inspiring them to pursue their own aspirations. Adapted into 12 different languages, the campaign's message of hope and inspiration serves as a rallying cry, encouraging individuals to make a positive impact on their families and communities with Life Insurance as the foundation.

As a responsible brand, we believe this campaign provides direction to individuals, liberating them to pursue their dreams while safeguarding the needs and aspirations of their loved ones. At SBI Life, we proudly stand by our brand philosophy – 'Apne Liye, Apno Ke Liye' – empowering individuals to live life to the fullest, for themselves and their dear ones.

Watch here: https://youtu.be/CbRgYA48cPk

In celebration of Mother's Day, SBI Life conducted the “Mummy Kahan Hai – #GuiltFreeMoms” campaign. Our objective was to connect with progressive mothers and encourage them to embrace self-care without guilt.

We carried out a social experiment validated by psychologists and substantiated our message through a heartwarming digital film.

The campaign sparked a movement, inspiring mothers to prioritise their happiness and well-being alongside their family responsibilities and not succumb to pressure of any perceived social stigma. Through this campaign, we also seamlessly communicated our brand message - "Karo Poore Apne Iraade, Apno Se Kiye Sabhi Vaade - Apne Liye, Apno Ke Liye." The campaign resonated with mothers nationwide, celebrating their journey with pride.

Over the years, we have carefully crafted Father's Day campaign – #PapaHainNa, to connect, communicate, and engage with our core target audience – fathers.

In 2022, we launched "Papa Ki Nayi Kahani" with an insight and narrative that seamlessly aligned with our brand's new philosophy – "Karo Poore Apne Iraade, Apno Se Kiye Sabhi Vaade – Apne Liye, Apno Ke Liye."

Our campaign focused on highlighting the evolving role of fathers, showcasing their exceptional ability to balance family responsibilities while pursuing their personal passions. We wanted to encourage fathers to find that perfect equilibrium between their dreams and their dedication to their families.

This campaign brought a fresh and meaningful perspective to fatherhood, resonating deeply with the new generation of fathers and their life philosophy.

Our award-winning breast cancer initiative, "Thanks A Dot," developed in collaboration with the Tata Cancer Association, is a source of immense pride for us at SBI Life. Our goal is to normalise self-breast examination and make it a habitual practice among women.

With this campaign, we strive to raise awareness about breast cancer and emphasise the importance of early detection through self-breast examination. We published creative content on 'Know Your Double O' through women-centric digital publications. In addition, we developed a WhatsApp bot to engage and educate women about breast health, ensuring accessibility and reach.

One of the key highlights of our initiative is organising interactive awareness camps across the country. These camps serve as a platform to educate and empower women, equipping them with life-saving skills for timely lump detection. Through open discussions and making breast health an accepted topic in society, we aspire to empower women to take charge of their well-being.

The response to our campaign has been overwhelming, with strong engagement from women all over India. We are truly honoured to be a part of this initiative that has the potential to save lives and create a positive impact on the lives of women.

Every year, on the delightful occasion of Friendship Day, we at SBI Life take the opportunity to establish camaraderie with our competition and partners in the insurance industry. We started a fun-filled Twitter banter with the narrative that all insurance brands are connected with a common goal – to contribute to a financially secure nation.

This unique campaign seamlessly integrates the common goal of the industry, partner brands' taglines, and SBI Life's brand purpose into the creative. By doing so, we celebrate the unity and shared vision among insurance providers, emphasising our commitment to securing the financial future of individuals and families.

The response to the campaign has been overwhelmingly positive, with our partners joining in the lighthearted banter, sharing interesting and playful responses. It serves as a fantastic platform to not only foster friendly competition but also increase the presence and awareness of the life insurance industry as a whole.

Year after year, this initiative allows us to strengthen our bonds with our peers, reinforcing the collective mission of securing lives and empowering individuals to lead financially protected lives. Friendship Day becomes more than just a celebration; it becomes a testament to the unity and determination of the insurance industry in working towards a common goal – a financially secure nation.