Empowering Life of Our Stakeholders

In our pursuit of building a strong and sustainable distribution network, we have a deep commitment to empowering our distributors by creating a dynamic and supportive ecosystem where they can thrive. We understand that our distributors are integral partners in our success, and by equipping them with the tools, resources, and support they need, we aim to create a world where their potential knows no bounds.

Material issues

Strategic objective

Focus areas

Key highlights

Establishing a robust distributor ecosystem

With a pan-India presence, we have established a robust network that caters to the diverse needs of our customers and provide support to our business partners in every corner of the country. As of FY23, we have expanded our reach through partner bank branches to further strengthen our distribution capabilities.

Strengthening our distribution network

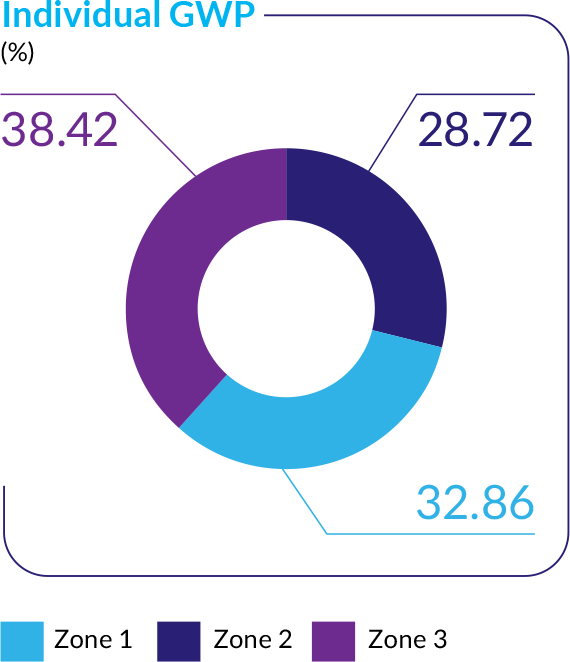

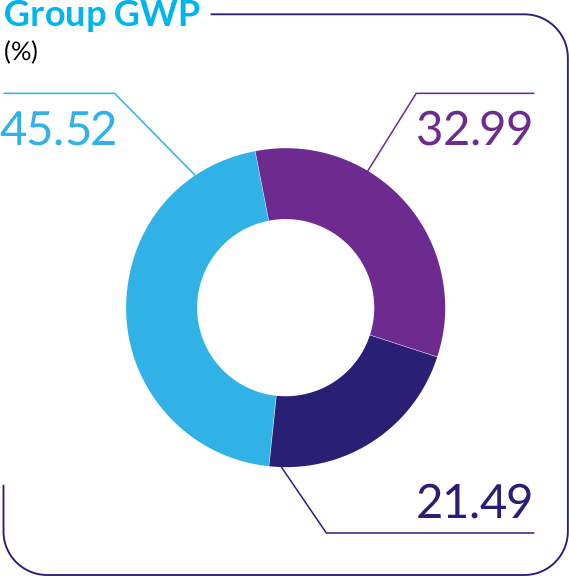

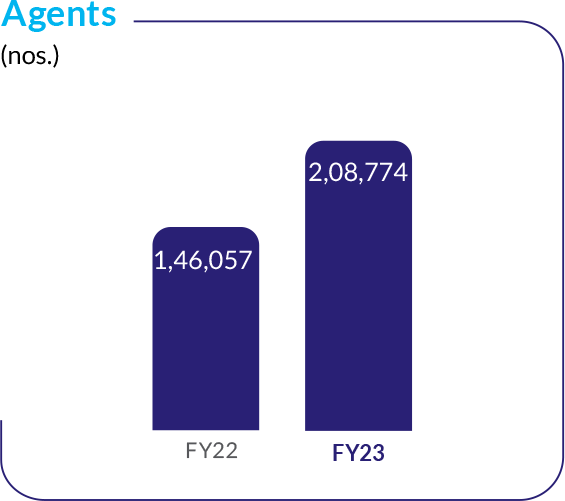

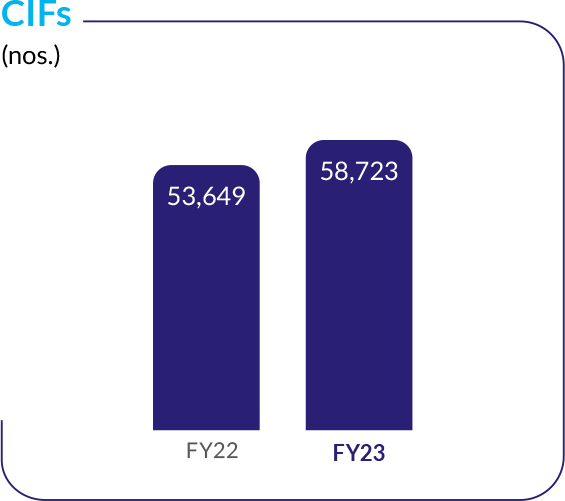

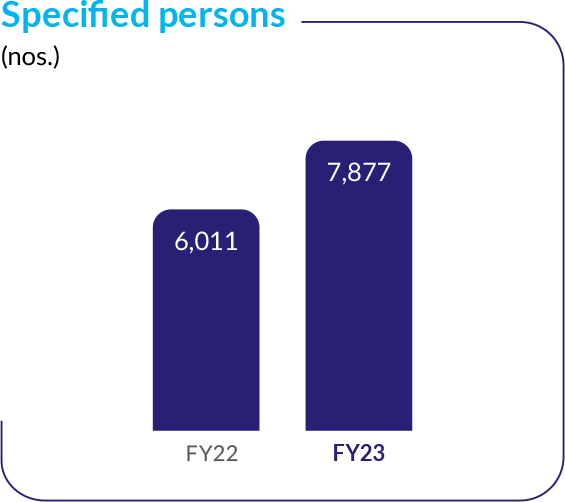

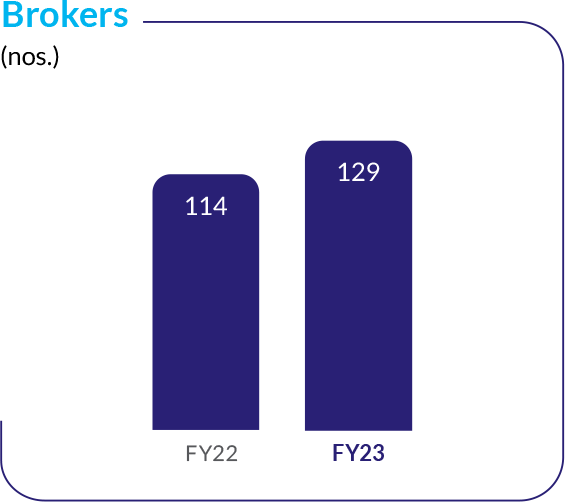

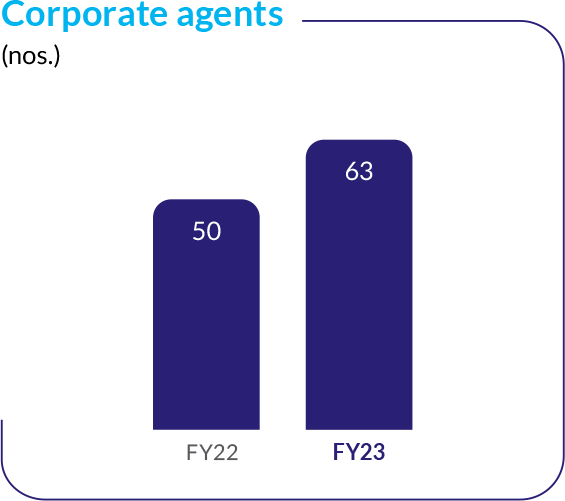

To strengthen our distribution network, we added more agents and expanded our network of intermediaries, which helped us to reach more customers and provide better services.

Partnering to expand the distribution network

To further expand our distribution reach and increase penetration, we have entered into strategic tie-ups with prominent institutions. Our new tie-ups include:

Karur Vysya Bank (KVB): This partnership enables SBI Life to expand its insurance market across the bank's presence in the country.

Paschim Banga Gramin Bank: A premier regional rural bank that strengthens our footprint in the East.

U Gro Capital Limited (Fintech): This partnership enhances our Credit Life business with 100+ branches spread across the country

India Post Payments Bank: Acting as a platform for improved penetration in rural markets, this tie-up empowers customers, particularly those in unbanked and underserved areas.

Fostering distributor engagement

We strongly believe in engaging our distributors actively, ensuring their success and growth. Our engagement initiatives include:

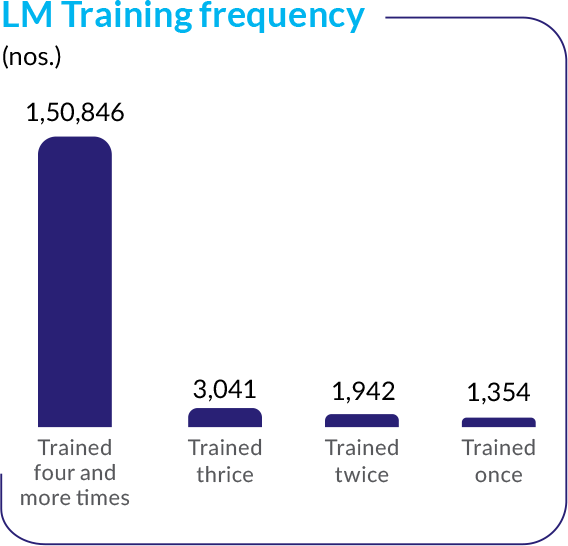

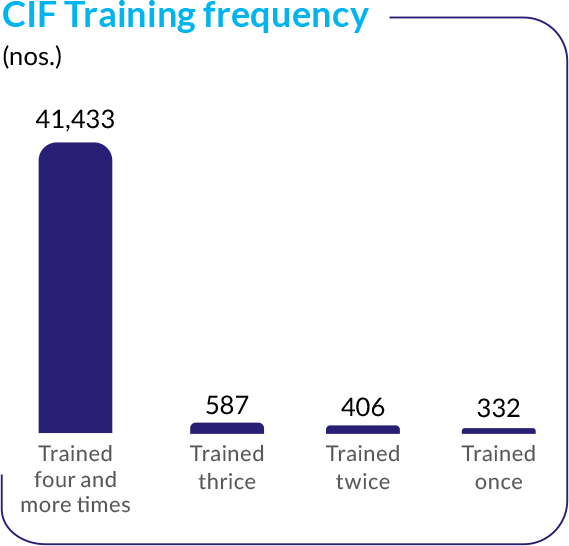

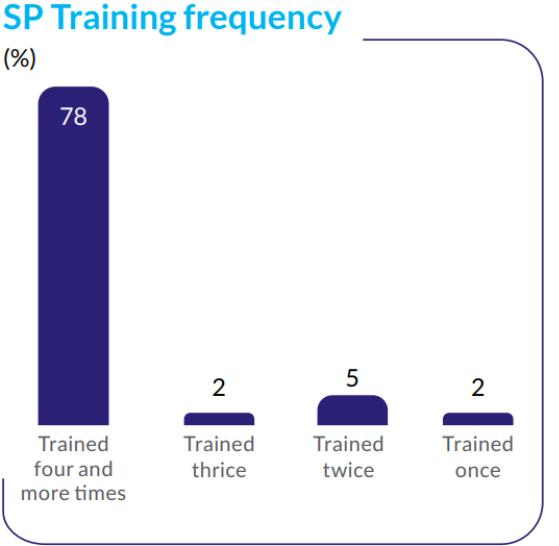

Training and development

Harnessing the power of digital technology

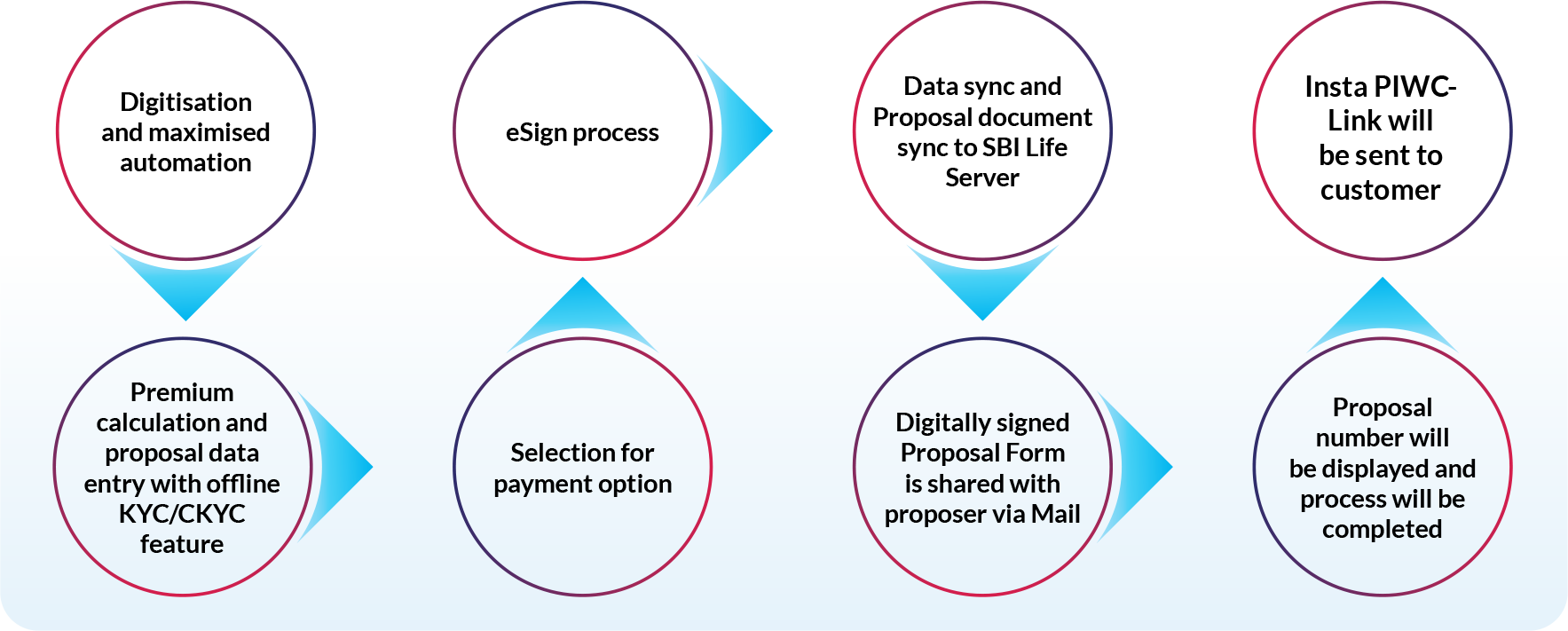

We have embarked on a transformative digital journey to empower our distributors with cutting-edge tools and technologies. Our digital initiatives include:

Mconnect Life:

Mconnect Life is a mobile-based application that enables sales representatives to sell SBI Life policies digitally. It streamlines the proposal form-filling process, facilitates premium payment and allows document uploads from mobile devices.

Mconnect PWA

It is a desktop/device-agnostic application designed to assist partner bank sales forces in selling SBI Life Insurance policies through a user-friendly desktop interface.

Smart Advisor Plus

SBI Life Smart Advisor Plus is a mobile/desktop application that provides our sales force and operations teams access to key business data, customer details, product information, premium details and various reports, enhancing their efficiency.

Partner bank Banca Online Portal

Through digital integration with partner banks, we ensure a seamless transition of business and provide necessary details at their fingertips.

Business intelligence and reporting

To support strategic decisionmaking, we have implemented various reporting and analytics platforms. These platforms, including AARAM Nxt, Crystal SAP BO, Banca Online, Agency Online, AASAN, and SAARTHI, provide comprehensive business insights and enable data-driven decision-making.

Highlights of FY23

In FY23, we focused on digital offerings and enhancing the onboarding experience for our partners and distributors. Our key initiatives include: