39,679

Agents

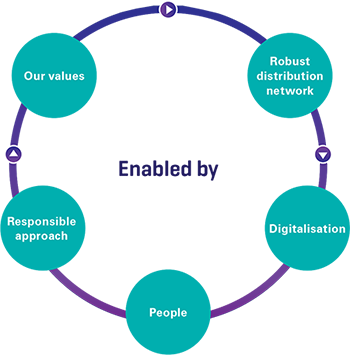

We have thoughtfully redefined our strategies and made well-informed decisions to remain relevant to all our stakeholders. We believe economic growth should create opportunities for all, which is why we are focused on building partnerships that foster inclusive growth across our value chain.

To be the most trusted and preferred life insurance provider

Agents

SPs

Brokers

New Policies added

Of renewal premium digitally collected

Increase in protection policies sold digitally

Engaged with

Trained insurance professionals versus 186,495 in FY20