Income

The primary income for an insurance company is premium which is collected periodically and over a long period of time.

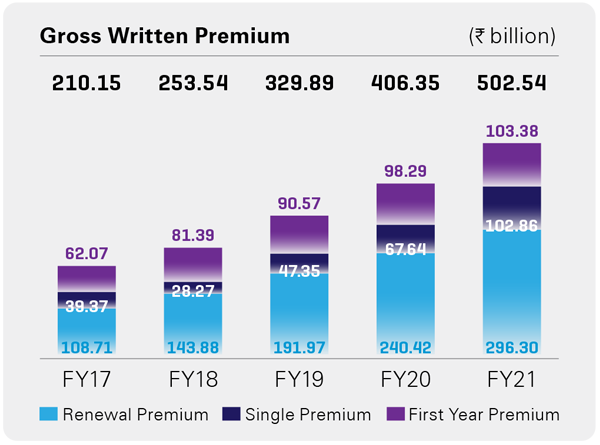

Gross Written Premium (GWP)

Total premium written by the Company before deductions for reinsurance ceded.

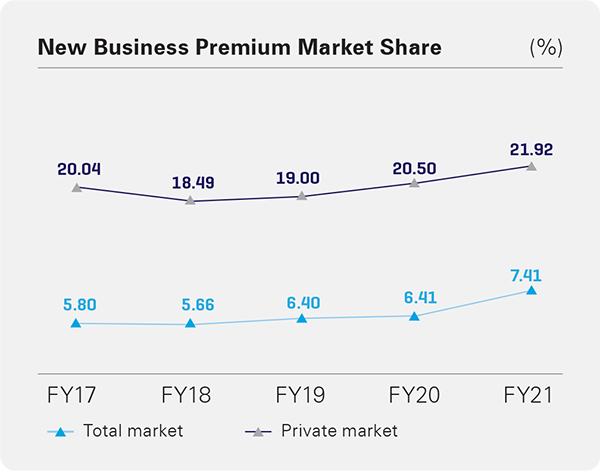

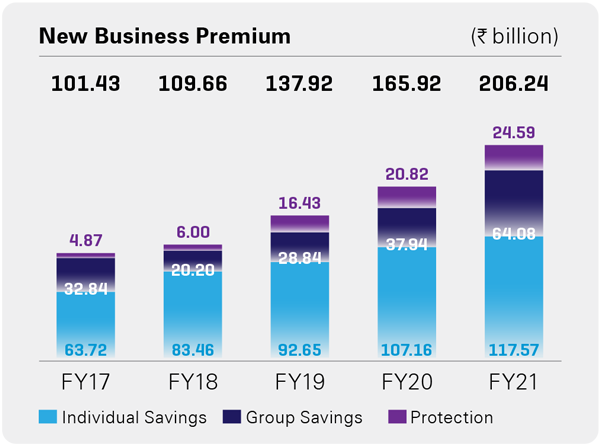

New Business Premium (NBP)

Insurance premium that is due in the first policy year of a life insurance contract or a single lump sum payment from the policyholder.

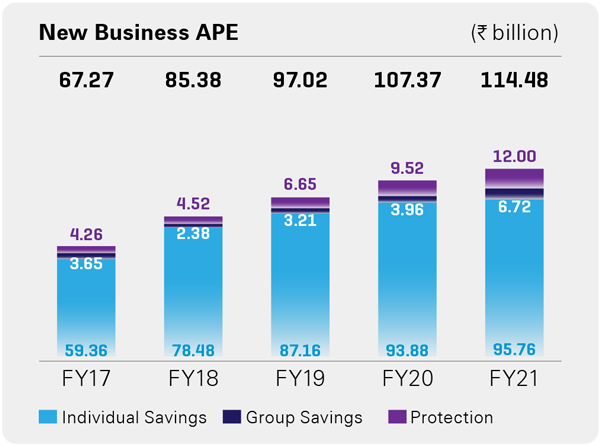

New business Annualised Premium Equivalent (APE)

Sum of annualised first year premium on regular premium policies and 10% of single premium written in a fiscal year.

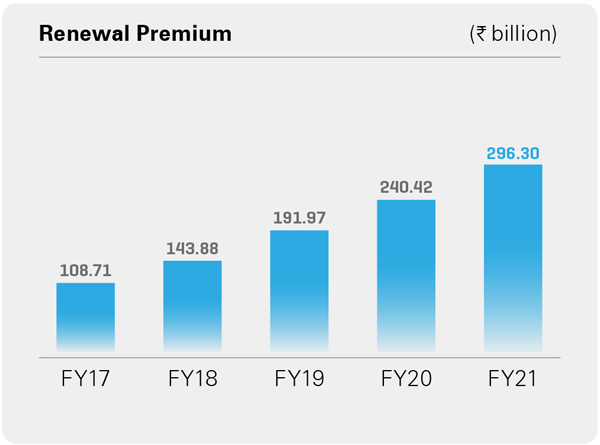

Renewal Premium

Life insurance premium falling due after the first year of the policy

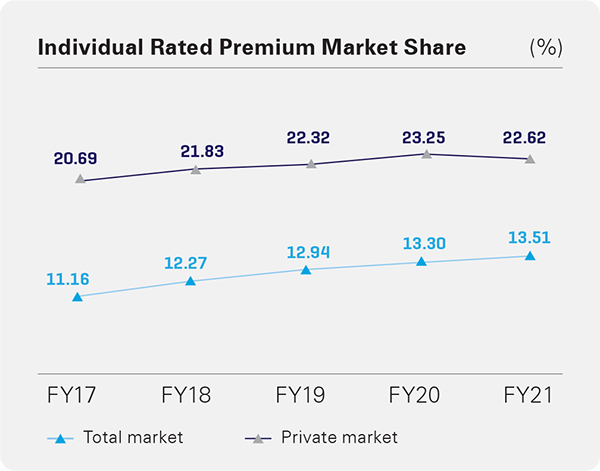

Individual Rated Premium (IRP)

Premium written under individual products and weighted at 10% for single premium.

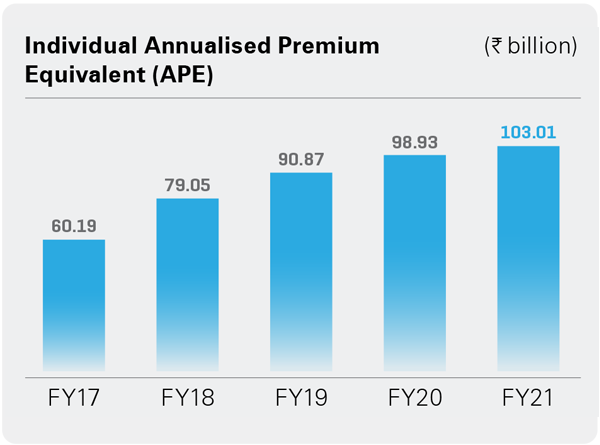

Individual Annualised Premium Equivalent (APE)

Sum of annualised first year premium on regular business and 10% of single premium for individual business.

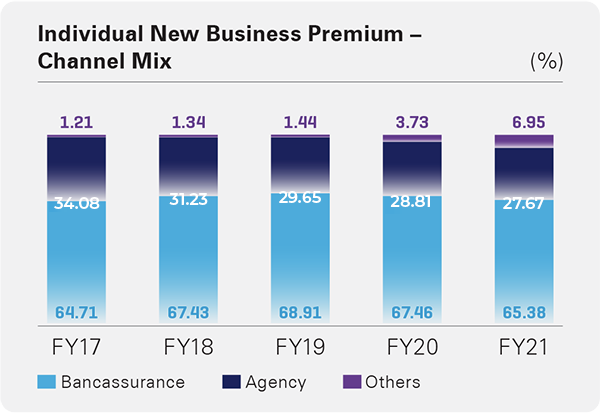

Individual New Business Premium – Channel Mix