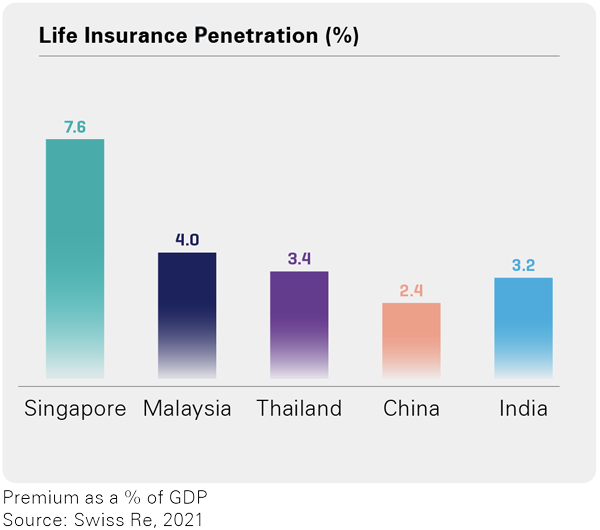

Under-penetration of life insurance in India

Insurance penetration is calculated as percentage of insurance premium to GDP. The life insurance industry in India has relatively low penetration as compared to other Asian countries with a marginal improvement to 3.20% in 2020 from 2.71% in 2001. However, the last decade has shown a steady growth in the industry owing to the increasing disposable income and rising awareness.

Our response

We have a widespread distribution network operating through multiple channels, reaching the remotest of locations across India. We engage customers and potential customers through effective communication and innovative product and service offerings.

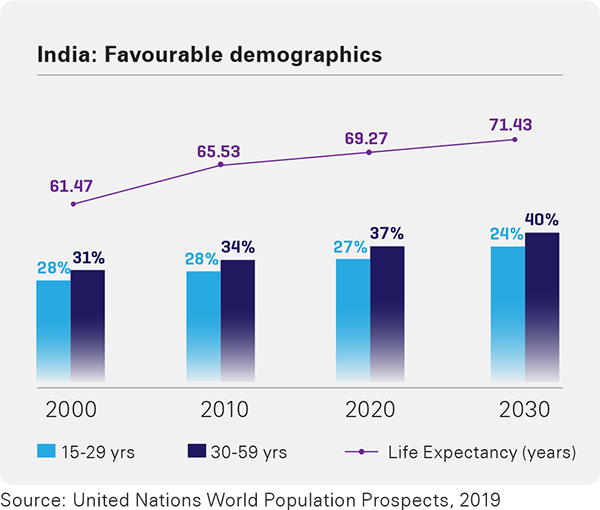

Rising disposable income with expanding middle class

India has a rapidly growing population of young, earning members with a disposable income. The share of working population is expected to reach 40% by 2030. Increased awareness about investments and life insurance makes India a captivating market for the life insurance industry. This has opened up a new and upcoming avenue for life insurers, backed by digital platforms, smart solutions and innovative technology.

Our response

Our products cater to different types of customers across age groups. We are developing innovative, need-based products to capture a sizeable market share of the younger population.

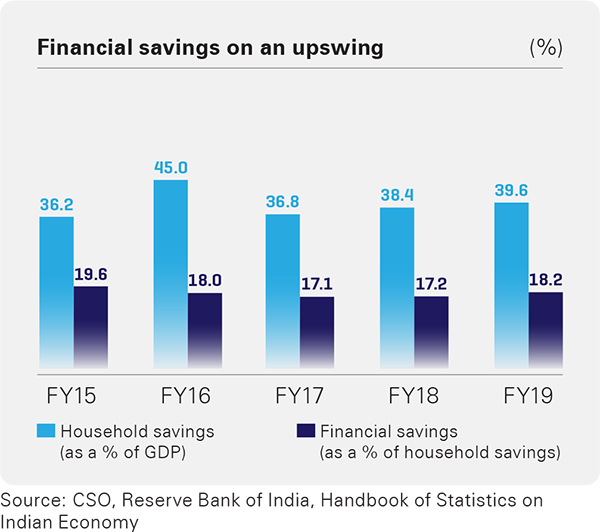

Financialisaton of savings

Over 90% of Indian households invest their hard-earned money in physical assets like real estate and gold. However, as India moves towards smart investment solutions aided by the government’s thrust on formalisation of finances, the demand for savings and protection products is on a rise. Increasing diversity of transactions and asset diversification are the key components of financial planning.

Our response

We are creating awareness about the importance of financial security across India through our multiple communication channels and leveraging digital platforms to engage customers and guide them towards choosing the appropriate insurance solution.

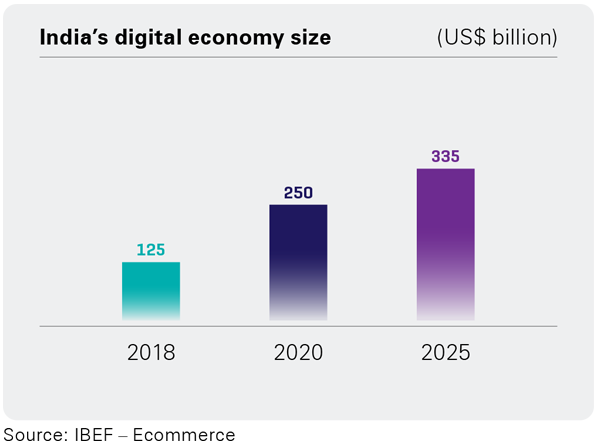

Digitalisation

The world is becoming more connected via internet and digital technologies. FY21 saw a shift of operation from a physical mode to a virtual mode and the advancement in digitalisation was accelerated owing to the ongoing pandemic. Digital technologies are key to the growth and continuation of businesses today. Further, the Government’s ‘Digital India’ initiative is driving the penetration and proliferation of smart and innovative solutions in the insurance industry as well.

Our response

We invested in incorporating digital technologies at all level of our operations, emerging as a leader in driving digitalisation in the Indian insurance industry. We leverage data tools to strengthen our existing systems and introduced new online services which are easy to use and accessible to our customers, distributors and business partners.

Rising awareness

The pandemic made people realise the gaps in their financial security. Uncertainty of life and pandemic-induced financial spending on medical aid increased demand for critical illness riders and pure protection term plans. The third quarter saw a multi-fold increase in the number of people opting for insurance plans with a 16% increase in New Business Premium in September 2020.

Our response

We customised our products and service channels to make them more accessible and affordable for all types of across demographics. We introduced four new products, simplified issuance and easy payout including the Corona Rakshak Policy to encourage customers to secure their financial future in times of crisis. We increased our marketing and communication to increase our customer base and strengthened our infrastructure.