STRENGTHS

STAYING AHEAD

OF THE CURVE

STRONG BRAND EQUITY AND PRE-EMINENT PROMOTERS

We take pride in being a part of the SBI Group, the country’s largest commercial bank in terms of deposits, advances and number of branches. Today, brand SBI has become synonymous with the trust of millions across the country and select overseas markets.

Our top-of-the-mind brand recall is a key growth enabler and lends an unmatched, distinct competitive edge. We are committed to optimising synergies with the parent entity, which provides us access to specialised industry expertise. We remain focused on strengthening our brand through impactful communication via different campaigns across several traditional (television, print and billboards) and contemporary (social media) platforms. Some of our recent campaigns can be viewed at https://www.youtube.com/user/sbilifeinsurance

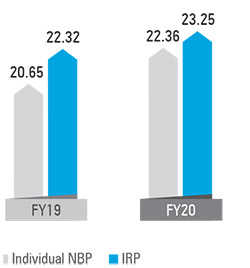

DOMINANT POSITION IN THE MARKET

Over the past two decades, we have earned the support and love of our customers by providing a comprehensive suite of relevant and innovative products. Our constant focus on providing superior services has helped retain existing customers and grow our wallet share. Today, as one of the leading private life insurers in India, we continue to gain market share by growing the market as well as gaining market share from peers.

Private market share (%)

Source: Swiss Re, sigma No 4/2020

Recognised as ‘The Best Life Insurance Company 2019 – Emerging Asia Insurance Awards’ by the Indian Chambers of Commerce