EXTERNAL ENVIRONMENT

RESPONDING TO

DYNAMIC TRENDS

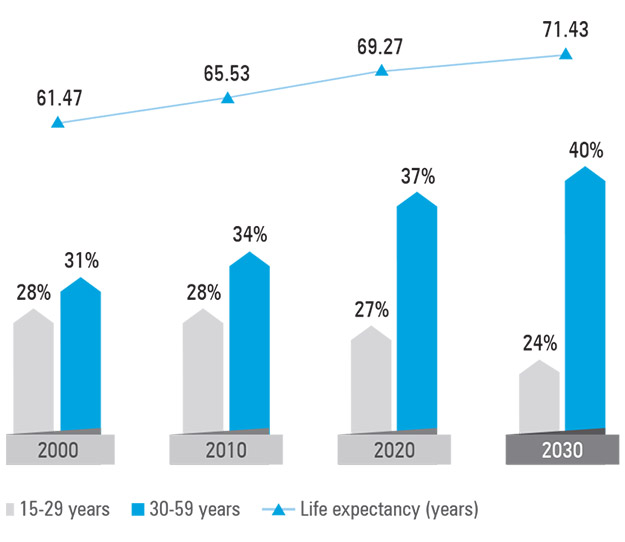

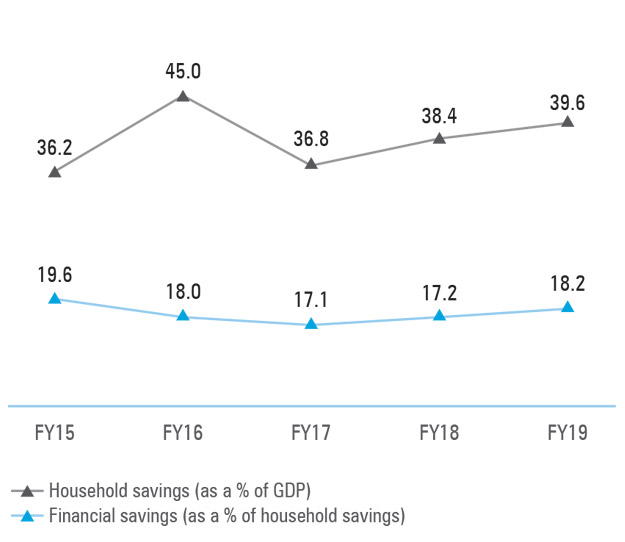

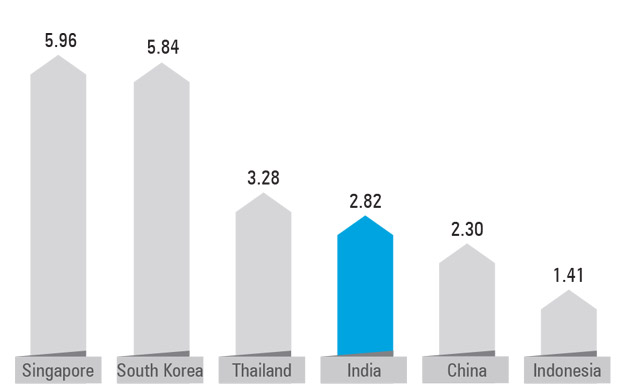

The Indian life insurance industry is one of the fastest growing markets and features among the top 10 globally in terms of premium. Backed by regulatory reforms and adoption of digital technologies, the industry is witnessing improved transparency and increased innovation. Further, the growing awareness of the need for protection products in navigating through life’s uncertainties is likely to catapult the industry to a much higher growth trajectory.