Our strengths

Our value proposition

STRONG BRAND EQUITY AND PRE-EMINENT PROMOTER

Our parent, SBI is the country’s largest commercial bank in terms of deposits, advances and number of branches. The bank enjoys unparalleled trust and support of consumers and has presence in key overseas markets as well. Our strong parentage lends us access to specialised industry expertise, facilitates growth of our business and enables us to consolidate our market position.

DOMINANT POSITION IN THE MARKET

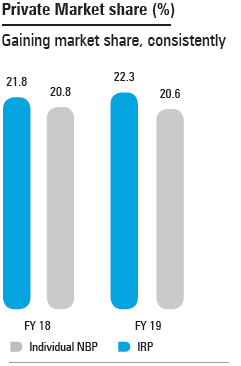

In our journey spanning over 18 years, we have provided diversified and innovative products through a multi‑channel distribution network and impeccable service to our esteemed patrons. Today, we are the leading private life insurer in India in terms of individual NBP and IRP, and are favourably placed to capitalise on the opportunities ahead.

ROBUST DISTRIBUTION NETWORK

In our business, staying closer and connected to our customers is of utmost importance. Our robust and thriving distribution network spans multiple channels. We have built the country’s largest bancassurance channel (including with SBI) and also have a large pool of individual agents. Our reach lends us an edge over our competitors and enables us to meet the needs of our customers in a timely and efficient manner.

Well connected

123,613

Individual Agents

22,000+

SBI branches

58,995

Certified Insurance Facilitator (CIFs)

1,844

Specified Persons(SPs)

CUSTOMER-FIRST APPROACH

Our customer-centric approach, focus on providing innovative products and a distribution network comprising a blend of physical and digital channels enable us to deliver improved customer experience. We have put in place multiple processes to ensure customer delight across their entire journey with us, from onboarding, servicing and engagement to claims settlement.

Best-in-class customer practices

95.03%

Individual Death Claims Settlement Ratio

0.10%

Mis-selling Ratio

CONSISTENT FINANCIAL TRACK RECORD

Since inception, we have focused on driving profitable growth and achieving higher efficiencies. We turned profitable within six years of our incorporation and have significantly improved our financials in the past few years. We are generating adequate growth capital for the future.

Solvency Ratio

(As on March 31, 2019)

2.13

SBI Life

1.50

IRDAI mandate

(Between FY 16 and FY 19)

20%+

CAGR in different premium metrics

16%

CAGR in Profit after tax

WELL-EXPERIENCED MANAGEMENT TEAM

Our expert management team and distinguished Board script our success story. While our Board comprises eminent professionals from different industries, our Senior Management team includes leaders with rich experience across Actuary, Underwriting, Finance, Investment, Claims management and Technology. Under their able guidance, we have made strategic decisions to remain a leader in our dynamic industry and take our business to its next level.

28+ years

Average experience of our management team