Our external environment

The trends that shape our markets

The Indian economy has been undergoing rapid transformation over the past four to five years. With a reform-oriented government at the helm for a second term and the regulators adopting a proactive approach to protect the interest of individuals and shore up transparency and disclosure standards, confidence in the banking and financial services sector has been on an upswing. We highlight some trends that are likely to shape the future of the life insurance sector in India.

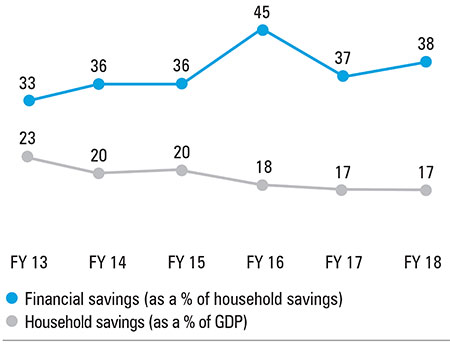

SHARE OF FINANCIAL SAVINGS

Government policies such as the Goods and Services Tax (GST) direct benefits transfer and Aadhaar linkages, are making the Indian economy more formal. Further, tighter scrutiny around investments made in physical assets such as gold and real estate has led to an increase in the financial savings done by households. Benign inflation, lower interest rates and stable economic growth are also creating higher investible surplus in the hands of households.

Financial savings

Source: CSO, Reserve Bank of India, Handbook of Statistics on Indian Economy

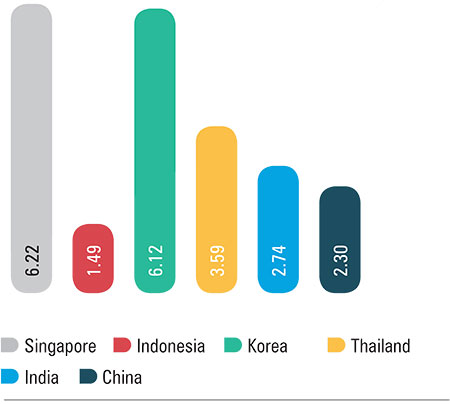

UNDER-PENETRATION OF LIFE INSURANCE IN INDIA

Penetration of life insurance products in India is still a fraction of that in both advanced and emerging economies. As regulator have become proactive to spread awareness about life insurance products and protect the interest of individuals, this trend is likely to improve in the future. Additionally, leading industry players are launching innovative products and enhancing reach to gain share.

Premium as a % of GDP: 2018

Source: Swiss Re, sigma No 3/2019

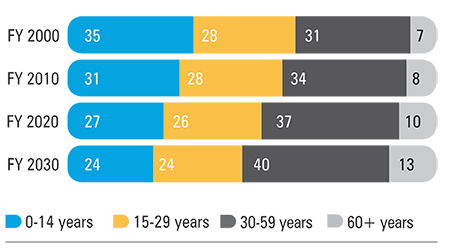

GROWING PIE OF MIDDLE-CLASS, WORKING POPULATION

India has a demographic advantage owing to its young, aspiring, growing working-age population and its expanding middle class. The country’s working population is likely to double over FY 16-26. The rising disposable income is likely to further drive flows into the insurance sector.

India: Population composition (%)

Source: United Nations World Population Prospects

Digital technology has the potential to break traditional barriers of insurance sector like product awareness level, limited customer touchpoints, access to knowledge, service availability and payments

FOCUS ON DRIVING DIGITALISATION

Increasing penetration of internet in India and government push to the cashless economy are enabling growth of digitalisation in India. Launch of Unified Payments Interface (UPI), Jan Aadhaar Mobile, linking of Aadhaar number with Personal Account Number (PAN) and availability of free Wi-Fi at public places, are some of the initiatives boosting the cashless economy in India. Insurance companies are also embracing digitalisation as new-age customers prefer purchasing insurance online due to the convenience that it provides.