Distinct offerings.

Closer to you.

To serve our customers better and strengthen our presence, we have put in place a strategic mix of branches, bancassurance channels and agents across India. Our ubiquitous distribution network allows us to stay closer to our customers, drive greater awareness about life insurance products and provide need-based solutions.

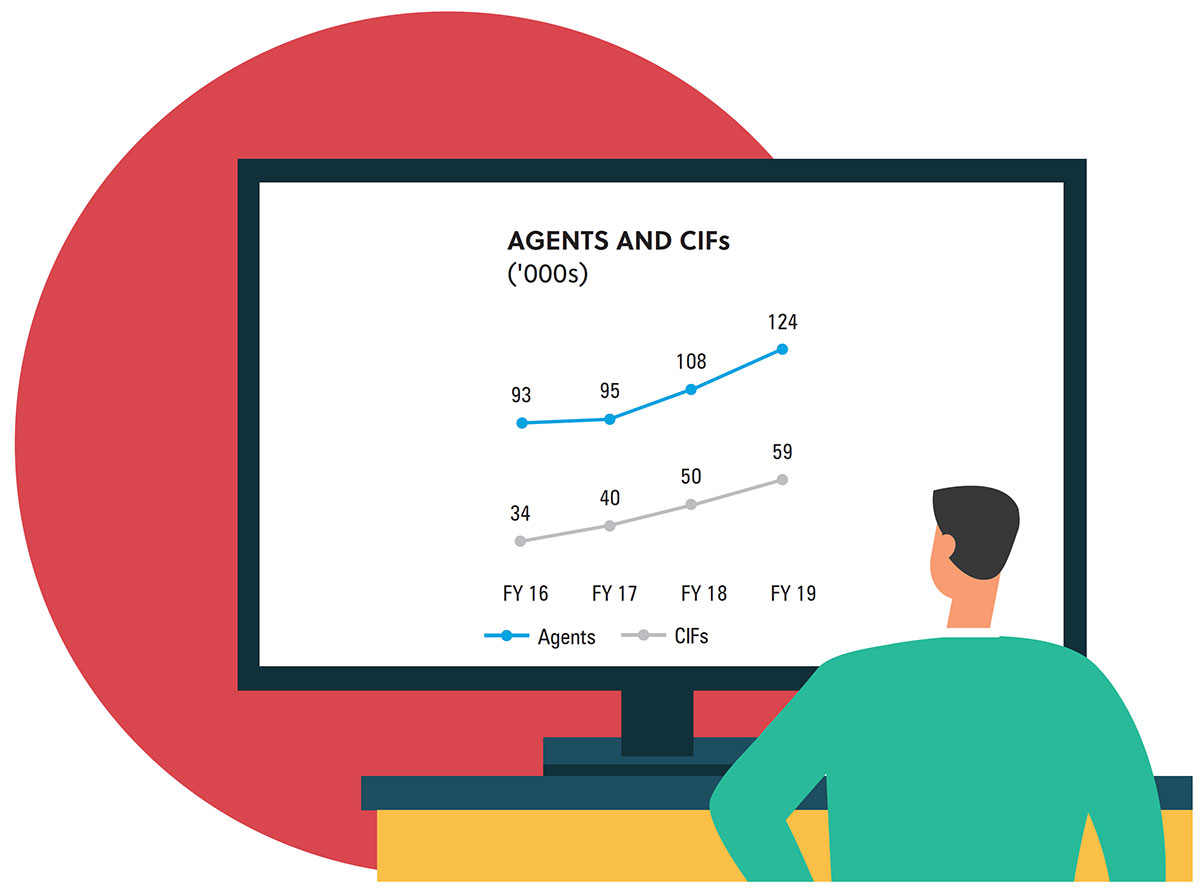

During the year, we added 83 offices, taking our total offices to 908. We also added 15,352 individual agents and 9,468 CIFs. We have 17 bancassurance partners and 99 brokers. Further, in addition to improving productivity of existing teams, we increased feet on ground and customer servicing employees. We also formed tie-ups with multiple distribution partners and help them improve productivity. From conducting regular training sessions to upskilling initiatives, we are constantly looking to optimise the potential of every distribution channel by supporting them in their growth plans.

Further, in addition to improving productivity of existing teams, we increased feet on ground and customer servicing employees

Our diversified suite of products and solutions are the output of manufactured capital. We are focused on improving margins by strategically calibrating our portfolio mix in favour of high-margin protection products. Although protection products have grown at a rapid pace, these products account for just 16% of our individual policies. We are looking to ramp up their share in the future.

By staying closer to our customers, we are taking utmost care of their convenience and are creating superior experience for them in a consistent manner. Our vast offerings and multi-channel distribution network goes a long way in delivering happiness to our customers and helping them go through life’s trials with relatively less stress.

Achieving all-round growth

AGENCY

- Growth in individual protection NBP by 149%

- Agency channel has sold 66,031 individual protection policies showing an increase of 97%

- Continue to drive protection business through Agency channel through digitisation and product innovationt

BANCASSURANCE

- Individual protection NBP has increase from `38 Cr to `321 Cr

- Individual protection policies sold by Bancassurance channel increased by 242%

- Credit Loan portfolio comprises of:

Home Loan 64%

Personal Loan 28%

Education Loan 7%

Vehicle Loan 1%

CORPORATE AGENTS, ONLINE

- Growth in individual protection NBP by 49% in Online channel (including web aggregators)

- 73% increase in individual protection policies sold through Online channel (including web aggregators)

- Tie-ups with 24 partners for Credit Loan protection business

174%

Growth in

protection (NBP)

16%

Share of protection

in indivdual NOP

176%

Growh in indiviual

protection NOP