Difference Between Financial Year and Assessment Year

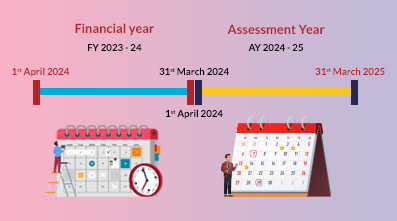

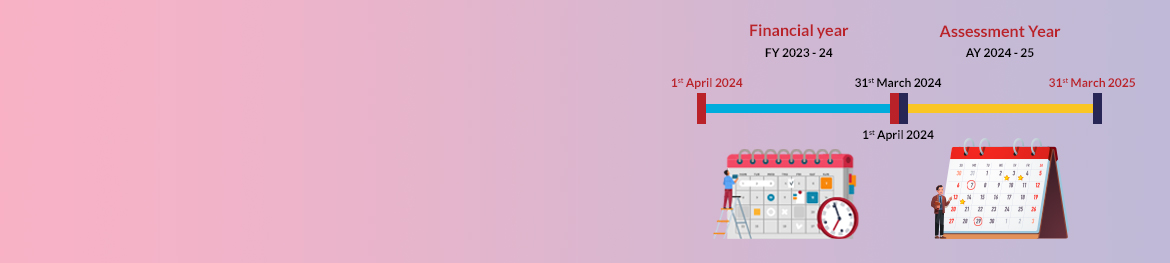

Understanding the difference between the financial year and assessment year is crucial for filing your taxes in India. Imagine the Financial Year (FY) as the earning period where you generate yearly income. The assessment year (AY) is like the exam period, where the income earned in the previous financial year is assessed and taxed. Let us dig deeper into the assessment year and financial year difference and understand the nitty-gritty of both.

What is a Financial Year?

The financial year in India follows a unique system, running from April 1st to March 31st of the following year. You will be amazed to know that India did not define its financial year itself. It inherited the concept from the British Raj.

Way back in 1867, the British government implemented the current financial year system, aligning it with their own practice (April 1st to March 31st of the following year). There have been discussions about potentially changing the financial year in India, but the current system remains in place.

During this financial year period, your income is generated from various sources like salaries, investments, or business ventures. Below are some examples to illustrate. If you receive a monthly salary, your income for FY 2023-24 will be calculated from your salary slips dated April 1st, 2023, to March 31st, 2024. If you earn interest from a fixed deposit, the interest earned between April 1st, 2023, and March 31st, 2024, will be considered income for FY 2023-24. It is important to keep track of your income throughout the FY to ensure accurate tax filing during the subsequent AY.

What is an Assessment Year?

The assessment year likely emerged alongside the Indian income tax system itself. It serves the purpose of evaluating income earned in a specific period (financial year) and levying taxes on it in the subsequent year.

The assessment year (AY) follows the financial year. It is the year when the Income Tax department assesses the income earned in the previous FY, and taxes are calculated and levied.

Here is how it works: The income you earned during FY 2023-24 (April 1st, 2023, to March 31st, 2024) will be assessed for tax purposes in the AY 2024-25 (which starts on April 1st, 2024). During the AY 2024-25, you will receive a tax notice mentioning the taxable income and the tax amount payable to the government. Understanding this distinction between FY and AY is essential for timely tax filing and avoiding penalties.

FY and AY for Recent Years

For better clarity, let's look at some recent FY and AY examples:

- FY 2021-22 (April 1st, 2021, to March 31st, 2022) - The income earned during this period was assessed for tax purposes in AY 2022-23 (April 1st, 2022, to March 31st, 2023).

- FY 2022-23 (April 1st, 2022, to March 31st, 2023) - The income for this period is currently being assessed in the ongoing AY 2023-24 (April 1st, 2023, to March 31st, 2024).

Remember, the FY is always the year before the corresponding AY.

Things to Remember When Filing Tax Returns in the Assessment Year

Filing tax returns in the AY requires transparency, utilising online platforms, and potentially using tax calculators for accurate calculations. Read the below-mentioned tips.

Transparency is Needed When Filing Tax Returns

Understanding the difference between the financial year and assessment year is crucial for transparent tax filing. The financial year (FY) is the 12-month period (April 1st to March 31st) during which you earn income. The assessment year (AY), which follows the financial year, is when the government assesses your income earned in the previous FY and determines your tax liability.

For instance, income earned in FY 2023-24 will be assessed for tax purposes in the AY 2024-25. So, when filing your tax return in the assessment year, ensure all income documents from the corresponding financial year are clear and accurate. This transparency helps avoid discrepancies and ensures a smooth tax filing process. Documents such as Form 26AS should also be kept handy for cross-checking and verification purposes.

Tax Returns Should Be Filed Online

Filing your tax return electronically in the assessment year is not just convenient; it promotes transparency. Gone are the days of paper trails and potential misplacement.

E-filing offers several advantages. Pre-filled data from sources like your employer reduces manual entry errors. Secure online storage eliminates the risk of lost paperwork. Additionally, faster processing often means quicker refunds. So, in the assessment year, embrace the efficiency and transparency of online tax filing.

Tax Return Calculators Ought to Be Made Use Of

Tax return calculators can be powerful allies during the assessment year. While they cannot replace a professional for complex situations, they offer a valuable first step, especially when understanding the difference between financial year and assessment year.

Tax return calculators can help estimate your tax liability for the assessment year by taking into account your income in the corresponding FY, potential deductions, and current tax rates. This estimate provides a helpful starting point and can flag any potential issues before you file your official return.

Important Things to Remember When Filing Taxes During Financial Year

Smart tax planning during the FY can simplify tax filing in the AY. Consider claiming deductions, maintaining organised expense records, and staying updated on tax regulations. Below are some smart tips.

Deductions Can Be Claimed Without Showing Receipts

While filing taxes in the financial year (April 1st to March 31st), claiming deductions without receipts can be tempting. However, it is crucial to understand the potential risks involved. There is a clear distinction between the financial year (FY) and the assessment year (AY). During the FY, you might encounter deductions, like travel allowances or medical expenses up to a specific limit, that allow claims without physical receipts.

However, the assessment year, which follows the FY, is when the tax department assesses your return and may request proof (receipts) for deductions claimed. While some exceptions exist, receipts are essential for verification for most deductions. To avoid discrepancies or delays during tax filing in the subsequent assessment year, it is highly recommended to maintain proper records of receipts throughout the financial year, even for those deductions that allow exceptions.

Organised Accounts of Expenses Must Be Kept

Keeping meticulous records of your expenses throughout the financial year (April 1st to March 31st) is crucial for a smooth tax filing experience in the following assessment year. This is especially important to remember because there is a clear difference between the financial year and assessment year.

Organised records with expense receipts allow you to substantiate deductions claimed when filing your tax return in the subsequent assessment year. This helps reduce the risk of errors or delays during tax processing. Some popular expense categories with deductions include medical bills, charitable donations, and interest paid on loans. By staying organised throughout the financial year, you will be prepared to file your tax return with confidence and transparency in the assessment year.

Note we are not talking about organising documents such as Form 26AS, which is issued by the Income Tax department in India.

Tax Payers Should Get Educated About Tax Filing Procedures and How They Work

Understanding tax filing procedures can significantly ease the process during the financial year (April 1st to March 31st). While the assessment year (the year following the financial year) is when you file your return, knowledge gained now empowers you for both.

Investing time in tax education during the financial year allows you to gather information, understand deductions, and navigate filing procedures. Numerous resources are available online or through government agencies to help you learn about tax brackets, deductions, and e-filing processes. This knowledge empowers you to make informed decisions throughout the financial year, ultimately leading to a smoother and more efficient tax filing experience in the assessment year.

Tax Preparation Software Can Be Used for Convenient Tax Filing

The financial year (April 1st to March 31st) is the perfect time to consider using tax preparation software. This can significantly improve your filing experience. Understanding the difference between the financial year and assessment year is key.

Tax preparation software simplifies data entry and calculations during the financial year. These programs can import income information from employers and investment firms, reducing errors and saving time. Additionally, some software offers guidance on deductions and tax credits you may be eligible for, potentially leading to a higher return. By leveraging tax software throughout the financial year, you can streamline the process and approach the assessment year with a well-organized tax filing experience.

Income from Deposits Should Be Shifted

While the tax implications will be realised in the assessment year (the year following the financial year), the financial year (April 1st to March 31st) is the time to consider diversifying your deposit income. This can potentially maximise your returns.

Traditionally, interest earned on savings accounts may not offer the highest returns. During the financial year, explore options like fixed deposits with higher interest rates or certificates of deposit (CDs). While these may lock your money for a period, they can potentially generate a better return than traditional savings accounts. Remember to factor in any penalties for early withdrawal when making your decision. By strategically planning your deposits in the financial year, you can potentially boost your overall income and maximise your tax benefit in the assessment year.

Filing Joint Returns Should Be Strictly Avoided in FY

The decision to file jointly can significantly impact your tax situation. While the assessment year (following the financial year) is when you file your return, careful planning during the financial year (April 1st to March 31st) is crucial.

Filing jointly in the financial year can be beneficial if one spouse has a significantly lower income. However, it can also combine your tax brackets, potentially pushing you into a higher bracket and increasing your overall tax liability. Analyse your and your spouse's income and deductions throughout the financial year. Consult a tax professional if needed to determine if filing jointly or separately in the subsequent assessment year is the most tax-advantageous option for your situation.

Frequently Asked Questions (FAQs)

Here are some answers to commonly asked questions regarding FY and AY.

Income Earned During What Period is Taxed?

The income you earn during the financial year (FY) is taxed in the subsequent assessment year (AY). For instance, income earned in FY 2023-24 will be taxed in AY 2024-25.

What is the Year Before the Assessment Year Known As?

The year preceding the assessment year is known as the financial year (FY). The income generated during this FY forms the basis for tax calculation in the following AY.

What is the Financial Year Called in Hindi?

The financial year in Hindi is called "Vaarthik Varsh" (वित्तीय वर्ष). It refers to the 12-month accounting period from April 1st to March 31st of the following year.

New FAQs:

Q. Why do we have different financial and assessment years in India?

India follows the April–March financial year system inherited from the British, to align with budgeting and revenue cycles.

Q. What happens if I file taxes for the wrong assessment year?

Filing under the wrong AY can lead to errors in processing, notices from the tax department, or penalties.

Q. Is the financial year the same for businesses and individuals?

Yes, in India the FY for both individuals and businesses runs from April 1 to March 31.

8 Minute

|

8 Minute

|

8 Minute |

8 Minute |