close

By pursuing your navigation on our website, you allow us to place cookies on your device. These cookies are set in order to secure your browsing, improve your user experience and enable us to compile statistics For further information, please view our "privacy policy"

SBI Life – Sampoorn Cancer Suraksha

UIN: 111N109V03

Product Code: 2E

Individual, Non-participating, Non-linked health insurance Pure Risk Premium product.

Cancer comes with a cost, both physical and emotional. However, being ready helps you fight back. So plan for it with SBI Life - Sampoorn Cancer Suraksha, that offers you complete financial support at every stage of your treatment so that today you remain liberated from worrying about Cancer and more focused on defeating it.

Key Features –

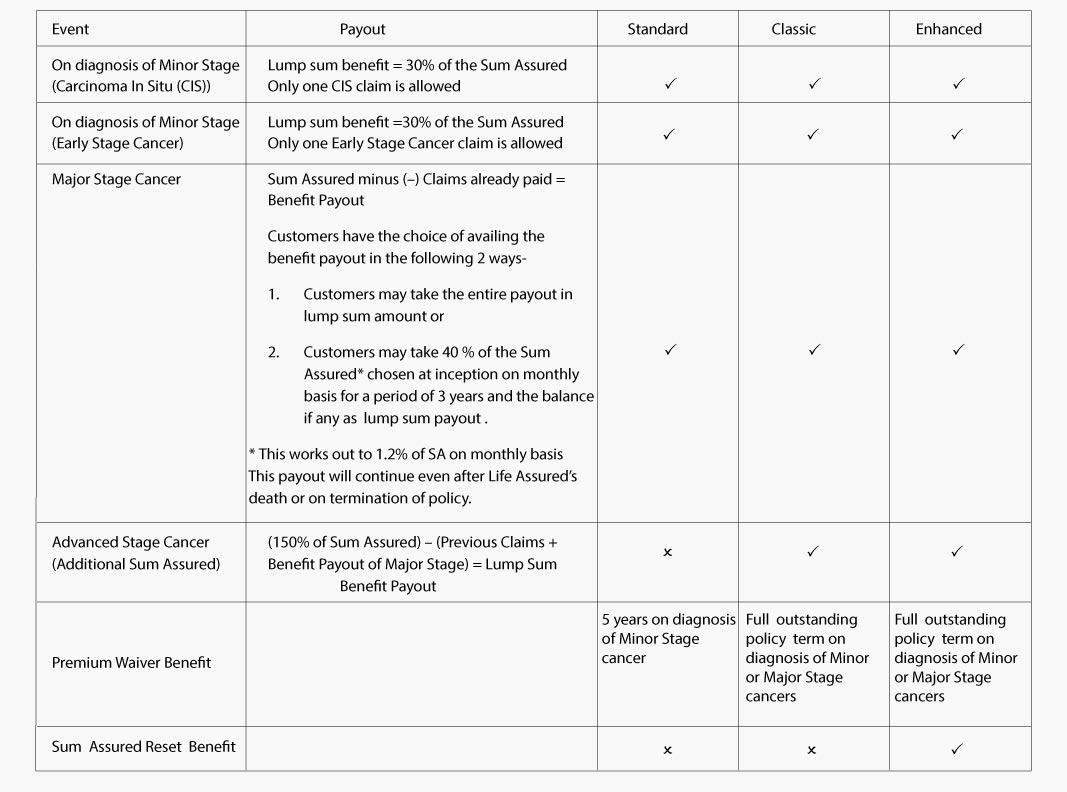

*Standard, Classic and Enhanced benefit structures to cover different stages of Cancer starting from Minor Stage Cancer (Carcinoma in Situ (CIS) & Early Stage cancer) to Major Stage Cancer and Advanced Stage Cancer.

#Based on the benefit structure chosen.

##A service which enables life assured, to receive second opinion of their diagnosis and treatment plans by another doctor. This service would be provided on the diagnosis of cancer and CIS only, provided the policy is in-force. Services are provided by Mediguide India.

Cancer comes with a cost, both physical and emotional. However, being ready helps you fight back. So plan for it with SBI Life - Sampoorn Cancer Suraksha, that offers you complete financial support at every stage of your treatment so that today you remain liberated from worrying about Cancer and more focused on defeating it.

Key Features –

- Comprehensive Cancer Insurance product with choice of 3 benefit Structures*

- In built Premium Waiver benefit# and availment of service of Medical Second Opinion##

- A simple enrollment process with no Medical Examination

*Standard, Classic and Enhanced benefit structures to cover different stages of Cancer starting from Minor Stage Cancer (Carcinoma in Situ (CIS) & Early Stage cancer) to Major Stage Cancer and Advanced Stage Cancer.

#Based on the benefit structure chosen.

##A service which enables life assured, to receive second opinion of their diagnosis and treatment plans by another doctor. This service would be provided on the diagnosis of cancer and CIS only, provided the policy is in-force. Services are provided by Mediguide India.

Highlights

Individual, Non-participating, Non-linked health insurance product

This is how 38-year old Ashwin will be financially prepared to defeat Cancer

Change the form fields below and see how you can be prepared with SBI Life - Sampoorn Cancer SurakshaName:

DOB:

Gender:

Male Female TransgenderDiscount:

Staff None OnlineReset

^For SBI Life staff purchasing offline - Filled in hard copy form

can also be submitted to the nearest SBI Life - Processing Center

Sum Assured

Premium frequency

Premium amount

(excluding taxes)

Policy & Premium Payment Term

Benefit Option

Benefit Option Description

Features

- Payouts Independent of actual expenses

- Option of Monthly Income benefit

- Medical Second opinion

- No medical examination

- Choice of three benefit structures

- Sum Assured Reset benefit

- In Built Premium waiver benefit

Advantages

Simplicity

- Easy and hassle free issuance process

- Claim payouts are independent of the nature/ amount of expenses incurred

Flexibility

- Compensate loss of income with monthly income benefit

Security

- Ensure your financial security through stage wise lump sum payout

Reliability

- Avail a medical second opinion from medical panel of experts

Affordability

- A perfect fit in your financial planning with reasonable premium

On diagnosis of cancer:

Sum Assured Reset Benefit: On completion of 3 years from the date of valid Minor or Major Cancer claim within the policy term, and subject to no further diagnosis of Cancer during the same period, the full Sum Assured will be restored provided the life assured had undergone medically necessary treatment for previous cancer(s). This benefit is not applicable to those with previous valid Advanced Cancer claim as the policy would terminate on Advanced Stage Cancer claim.

Medical Second Opinion:

A service which enables life assured, to receive second opinion of their diagnosis and treatment plans by another doctor. This service would be provided on the diagnosis of cancer and CIS only, provided the policy is in-force.Services are provided by Mediguide India.

On Maturity:

There is no maturity benefit available under this product.On Death:

There is no death benefit available under this product.For more details on risk factors, terms and conditions of SBI Life – Sampoorn Cancer Suraksha, read the following documents carefully.

$All the references to age are age as on last birthday.

2For Monthly mode, upto 3 Months premium to be paid in advance and renewal premium payment through Electronic Clearing System (ECS) or Standing Instructions (where payment is made either by direct debit of bank account or credit card)

For Monthly Salary Saving Scheme (SSS), upto 2 month premium to be paid in advance and renewal premium payment is allowed only through Salary Deduction

NW/2E/ver1/03/22/WEB/ENG

For details regarding the coverage, definitions, exclusions, waiting period, risk factors, terms and conditions please read the sales brochure carefully before concluding a sale.

Tax Benefits:

Tax benefits are as per Income Tax Laws & are subject to change from time to time. Please consult your Tax advisor for details.

You are eligible for Income Tax benefits/exemptions as per the applicable income tax laws in India, which are subject to change from time to time. For further details, click here.

Tax Benefits:

Tax benefits are as per Income Tax Laws & are subject to change from time to time. Please consult your Tax advisor for details.

You are eligible for Income Tax benefits/exemptions as per the applicable income tax laws in India, which are subject to change from time to time. For further details, click here.